Navigating the financial landscape of 2024 requires a keen understanding of evolving market trends and strategic investment approaches. This guide delves into the best investment strategies for the year ahead, exploring diverse asset classes and offering insights into risk management and ethical considerations. We’ll examine the stock market outlook, analyze bond market dynamics, and investigate the potential of real estate and alternative investments, providing a comprehensive framework for informed decision-making.

From understanding the interplay of interest rates and bond prices to identifying promising real estate markets and diversifying your portfolio with alternative investments, we aim to equip you with the knowledge necessary to navigate the complexities of the 2024 investment landscape. We’ll also address crucial aspects such as tax implications and responsible investing practices, ensuring a holistic approach to wealth management.

Introduction

presents a complex investment landscape. Global economic uncertainty, driven by factors like persistent inflation, geopolitical instability, and evolving technological advancements, necessitates a carefully considered investment strategy. While predicting the future is impossible, understanding the prevailing economic climate and identifying key trends can significantly improve the chances of achieving investment goals. This section will explore the current economic context, significant global trends, and a brief overview of various asset classes to provide a foundation for informed investment decisions.The current economic climate is characterized by a persistent, albeit potentially slowing, inflationary environment.

Central banks worldwide are navigating a delicate balance between controlling inflation and avoiding a recession. Geopolitical tensions, particularly the ongoing conflict in Ukraine and increasing US-China rivalry, contribute to market volatility and supply chain disruptions. These factors influence interest rates, currency exchange rates, and overall market sentiment, creating both risks and opportunities for investors.

Major Global Trends Shaping Investment Opportunities in 2024

Three significant global trends are likely to shape investment opportunities in 2024: the ongoing energy transition, the rise of artificial intelligence (AI), and the evolving geopolitical landscape. The shift towards renewable energy sources presents significant investment potential in sectors like solar power, wind energy, and battery technology. Companies leading the charge in AI development and implementation are also likely to experience substantial growth.

Finally, geopolitical shifts will continue to influence investment decisions, requiring careful consideration of regional risks and opportunities. For example, increased investment in domestic manufacturing and reshoring initiatives in response to geopolitical uncertainties could present lucrative opportunities.

Overview of Investment Asset Classes

Investors can diversify their portfolios across various asset classes, each with its own risk-reward profile. Stocks represent ownership in companies and offer the potential for high returns but also carry higher risk. Bonds, on the other hand, are debt instruments offering relatively lower risk and steady income. Real estate, encompassing residential and commercial properties, can provide both income and capital appreciation but involves illiquidity and significant upfront investment.

Other asset classes include commodities (like gold and oil), alternative investments (like private equity and hedge funds), and cryptocurrency, each with its unique characteristics and potential. A well-diversified portfolio, tailored to individual risk tolerance and financial goals, is crucial for navigating the complexities of the 2024 investment landscape. For example, a balanced portfolio might include a mix of stocks, bonds, and real estate to mitigate risk and potentially achieve higher returns than investing solely in one asset class.

Bond Market Analysis and Strategies

The bond market, a cornerstone of any diversified investment portfolio, presents both opportunities and challenges in 2024. Understanding the interplay between interest rates and bond prices, as well as the characteristics of different bond types, is crucial for navigating this market effectively. This section will analyze the bond market landscape, exploring potential interest rate movements and outlining suitable bond strategies for various investor risk profiles.Interest Rates and Bond Prices: An Inverse RelationshipInterest rates and bond prices share an inverse relationship.

When interest rates rise, the yields on newly issued bonds become more attractive, causing the prices of existing bonds with lower coupon rates to fall. Conversely, when interest rates fall, the demand for existing bonds with higher coupon rates increases, pushing their prices up. Predicting interest rate movements is inherently challenging, but considering the current economic climate, a moderate increase in interest rates is a possibility in 2024, though the pace and extent remain uncertain.

For example, the Federal Reserve’s actions in managing inflation will significantly influence this trajectory. A scenario similar to 2022, with several rate hikes, could potentially repeat, though the exact number and timing are subject to considerable uncertainty and depend on various economic indicators.

Types of Bonds and Investor Suitability

Government bonds, corporate bonds, and municipal bonds each possess unique characteristics that cater to different investor profiles.Government bonds, issued by national governments, are generally considered low-risk investments due to the backing of the government’s taxing power. They offer lower yields compared to corporate bonds but provide greater stability, making them ideal for conservative investors seeking capital preservation. Examples include U.S.

Treasury bonds and notes.Corporate bonds, issued by companies to raise capital, carry higher risk than government bonds because their repayment depends on the issuer’s financial health. However, they offer potentially higher yields to compensate for this increased risk. Investors with a higher risk tolerance and a longer-term investment horizon may find corporate bonds attractive. The risk profile varies widely depending on the credit rating of the issuing corporation.

A high-yield corporate bond, for example, offers a higher yield but also a higher risk of default.Municipal bonds, issued by state and local governments to finance public projects, offer tax advantages to investors. The interest earned on municipal bonds is often exempt from federal income tax, and sometimes from state and local taxes as well. This tax-exempt feature makes them particularly appealing to investors in higher tax brackets.

However, municipal bonds generally offer lower yields than taxable bonds.

Sample Bond Portfolios

A conservative investor might favor a portfolio heavily weighted towards government bonds and high-quality corporate bonds with investment-grade ratings. For example, a portfolio could consist of 70% U.S. Treasury bonds, 20% high-grade corporate bonds, and 10% municipal bonds. This strategy prioritizes capital preservation and minimizes risk.Conversely, a more aggressive investor might allocate a larger portion of their portfolio to higher-yielding corporate bonds and emerging market debt.

An example might include 30% U.S. Treasury bonds, 40% investment-grade corporate bonds, 20% high-yield corporate bonds, and 10% emerging market debt. This approach aims for higher returns but accepts a higher level of risk. It’s crucial to remember that past performance does not guarantee future results and diversification is key to mitigating risk. This aggressive portfolio requires a longer time horizon and a higher tolerance for potential losses.

Alternative Investments for Diversification

Diversifying a portfolio beyond traditional assets like stocks and bonds is crucial for mitigating risk and potentially enhancing returns. Alternative investments, while often carrying higher risk, can offer unique characteristics that complement a traditional portfolio and provide exposure to different market forces. This section explores several key alternative investment classes and their roles in a well-rounded investment strategy.

Commodities as Portfolio Diversifiers

Commodities, encompassing raw materials like gold, oil, and agricultural products, can act as a hedge against inflation and provide diversification benefits. Their prices often move independently of traditional asset classes, offering a potential buffer during market downturns. For example, during periods of high inflation, the price of gold often increases as investors seek a store of value. However, commodity markets can be highly volatile, influenced by factors such as geopolitical events, weather patterns, and supply chain disruptions.

Investing in commodities directly can be complex, so many investors utilize exchange-traded funds (ETFs) or futures contracts to gain exposure. The risk lies in the inherent price volatility and the potential for significant losses if market conditions turn unfavorable.

Precious Metals: A Safe Haven Asset Class

Precious metals, primarily gold and silver, are often considered safe haven assets, meaning their value tends to rise during times of economic uncertainty or geopolitical instability. This characteristic stems from their perceived scarcity and historical role as a store of value. Gold, in particular, has historically performed well during periods of inflation. However, precious metals typically offer low or no yield, and their price can be susceptible to market sentiment and currency fluctuations.

Investing in physical gold or silver involves storage costs and security concerns, while ETFs and mining company stocks offer alternative exposure with their own set of risks.

Private Equity: Higher Returns, Higher Risk

Private equity involves investing in privately held companies, often through partnerships or funds. This asset class offers the potential for higher returns compared to publicly traded stocks, but it also comes with significantly higher risk and lower liquidity. Access to private equity investments is often restricted to accredited investors due to the complexities and illiquidity involved. Returns are not guaranteed, and investments can be locked up for extended periods, making it crucial to have a long-term investment horizon.

Examples of successful private equity investments include early-stage investments in companies like Google or Facebook, which yielded enormous returns for investors. However, many private equity investments fail to generate significant returns, highlighting the inherent risk.

Hypothetical Portfolio Allocation

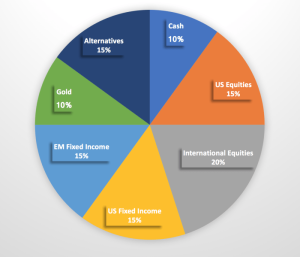

A hypothetical portfolio aiming for diversification might allocate assets as follows: 60% in traditional investments (40% stocks, 20% bonds), 20% in commodities (primarily through ETFs), 10% in precious metals (gold ETF), and 10% in private equity (through a diversified fund). This allocation reflects a moderate risk tolerance, with a significant portion in traditional assets for stability and a smaller allocation to alternatives for diversification and potential higher returns.

The specific allocation would, of course, need to be adjusted based on individual risk tolerance, investment goals, and time horizon. It’s important to remember that this is a hypothetical example, and individual circumstances should always dictate investment decisions.

Investment Advice

Making sound investment decisions requires a careful blend of financial acumen and ethical considerations. Successfully navigating the complexities of the market necessitates a thorough understanding of risk management and a commitment to responsible investing. This section delves into the crucial aspects of due diligence, risk management strategies, and the ethical dimensions of investment choices.

Due diligence is the cornerstone of informed investment decisions. It involves a comprehensive and meticulous investigation into an investment opportunity before committing capital. This process goes beyond simply reviewing financial statements; it includes assessing the management team’s competence, understanding the competitive landscape, and evaluating the long-term viability of the investment. For example, before investing in a start-up, due diligence might involve scrutinizing their business plan, analyzing market trends, and investigating the experience and track record of the founders.

Similarly, investing in a publicly traded company requires analyzing financial reports, assessing their debt levels, and researching their competitive position within their industry. A thorough due diligence process significantly reduces the likelihood of making poorly informed investment decisions.

Risk Management Strategies

Effective risk management is paramount in protecting your investments and achieving your financial goals. This involves a multi-faceted approach that considers both the inherent risks associated with different investment types and your personal risk tolerance.

Diversification is a fundamental risk management strategy. By spreading your investments across various asset classes (stocks, bonds, real estate, etc.), you reduce the impact of any single investment’s underperformance. For instance, if the stock market experiences a downturn, the losses in your stock portfolio might be offset by gains in your bond holdings or other asset classes. A well-diversified portfolio is not immune to market fluctuations, but it is significantly more resilient to major losses.

Assessing your risk tolerance is crucial in determining the appropriate investment strategy for your circumstances. Your risk tolerance reflects your comfort level with the potential for investment losses. A conservative investor might prioritize capital preservation and opt for lower-risk investments like government bonds, while a more aggressive investor might be willing to accept higher risk for the potential of greater returns by investing in high-growth stocks or emerging markets.

Understanding your risk tolerance helps you make investment choices that align with your financial goals and your personal comfort level. It is important to remember that higher potential returns usually come with higher risks.

Ethical Considerations in Investing

Responsible investing is not merely about maximizing returns; it’s about aligning your investments with your values and contributing to a more sustainable and equitable future. Ethical considerations should be an integral part of your investment strategy. This includes considering the environmental, social, and governance (ESG) factors of companies you invest in. For example, avoiding companies with poor environmental records or those involved in unethical labor practices is a key aspect of responsible investing. Furthermore, supporting companies that demonstrate strong corporate governance and transparency promotes long-term value creation and contributes to a more responsible business environment. By integrating ESG factors into your investment decisions, you can generate positive social and environmental impact alongside financial returns. This approach is becoming increasingly important as investors recognize the interconnectedness of financial performance and social responsibility.

Successfully navigating the investment world in 2024 demands a balanced approach encompassing thorough due diligence, effective risk management, and a commitment to ethical practices. By carefully considering the potential of various asset classes, understanding market dynamics, and tailoring strategies to individual risk tolerance, investors can position themselves for success. Remember, diversification is key, and seeking professional advice when needed is a prudent strategy.

Question Bank

What are the biggest risks facing investors in 2024?

Significant risks include inflation, geopolitical instability, and potential interest rate hikes impacting various asset classes. Careful diversification and risk assessment are crucial.

How can I determine my risk tolerance?

Consider your financial goals, time horizon, and comfort level with potential losses. Online questionnaires and consultations with financial advisors can assist in determining your risk profile.

What is responsible investing?

Responsible investing considers environmental, social, and governance (ESG) factors alongside financial returns, aligning investments with personal values and contributing to positive societal impact.

Are cryptocurrency investments viable in 2024?

Cryptocurrency remains a high-risk, high-reward asset class. Thorough research, understanding of the technology, and careful risk management are essential before considering any investment.