Navigating the complexities of investment and tax laws can feel daunting, but understanding tax-efficient investment strategies is crucial for maximizing your returns. This guide unravels the intricacies of building a portfolio that not only grows your wealth but also minimizes your tax burden. We’ll explore various tax-advantaged accounts, delve into the tax implications of different asset classes, and provide actionable strategies for optimizing your investment approach.

From understanding capital gains taxes and tax loss harvesting to crafting a diversified, long-term investment plan, we’ll equip you with the knowledge to make informed decisions. We’ll also address the importance of seeking professional financial advice tailored to your individual risk tolerance and financial goals, ensuring a secure and prosperous financial future.

Tax Loss Harvesting

Tax loss harvesting is a powerful strategy that allows investors to offset capital gains with capital losses, ultimately reducing their overall tax liability. This technique involves selling investments that have lost value to generate capital losses, which can then be used to offset capital gains realized from other investments during the same tax year. Understanding and effectively implementing this strategy can significantly improve your investment returns after tax.Tax Loss Harvesting: Process and BenefitsTax loss harvesting involves strategically selling losing investments to create a capital loss, which can then be used to offset capital gains.

The key is to reinvest the proceeds from the sale into similar investments to maintain your overall portfolio strategy. This process allows you to reduce your tax burden without significantly altering your long-term investment goals. The primary benefit is a lower tax bill, leaving more of your investment returns in your pocket. It’s important to remember that you can only deduct up to $3,000 ($1,500 if married filing separately) of net capital losses against ordinary income in a single year.

Any excess losses can be carried forward to future tax years.

Examples of Tax Loss Harvesting

The following examples illustrate how tax loss harvesting can reduce your tax liability. These examples are simplified for illustrative purposes and do not consider all potential tax implications. Consult with a qualified financial advisor for personalized advice.

- Scenario 1: Offsetting Gains: Suppose you sold stock A for a $5,000 gain and stock B for a $5,000 loss. Through tax loss harvesting, the $5,000 loss offsets the $5,000 gain, resulting in no capital gains tax liability for these transactions.

- Scenario 2: Partial Offset: You sold stock C for a $10,000 gain and stock D for a $3,000 loss. The $3,000 loss offsets $3,000 of the gain, leaving a $7,000 taxable gain. This reduces your tax liability compared to not harvesting the loss.

- Scenario 3: Excess Losses: You sold stock E for a $2,000 gain and stock F for a $5,000 loss. You can deduct $3,000 of the loss against your ordinary income, reducing your taxable income. The remaining $2,000 loss can be carried forward to offset future capital gains.

Step-by-Step Guide to Tax Loss Harvesting

Effectively implementing tax loss harvesting requires a systematic approach. Here’s a step-by-step guide to help you navigate the process:

- Identify Losing Investments: Review your investment portfolio to pinpoint assets that have decreased in value. Consider both short-term and long-term capital losses.

- Determine the Wash-Sale Rule: Be aware of the wash-sale rule, which prevents you from claiming a loss if you repurchase substantially identical securities within 30 days before or after the sale. If you want to maintain exposure to the same asset class, consider purchasing a similar, but not identical, investment.

- Calculate Potential Tax Savings: Estimate the potential tax savings by calculating the amount of capital losses you can offset against capital gains or ordinary income.

- Sell Losing Investments: Execute the sale of the identified losing investments before the end of the tax year to realize the capital loss.

- Reinvest Proceeds: Reinvest the proceeds from the sale into similar investments to maintain your overall investment strategy. This ensures you don’t disrupt your long-term financial goals.

- Document Transactions: Meticulously record all transactions, including dates, purchase prices, and sale prices, to accurately report capital gains and losses on your tax return.

Ultimately, tax-efficient investing isn’t about avoiding taxes entirely; it’s about strategically managing them to enhance your long-term financial well-being. By understanding the principles Artikeld in this guide and actively implementing the strategies discussed, you can build a robust investment portfolio designed to weather market fluctuations while minimizing your tax liability. Remember to consult with a qualified financial advisor to personalize your approach and ensure it aligns with your specific circumstances and aspirations.

Answers to Common Questions

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA offers tax deductions on contributions, but withdrawals are taxed in retirement. A Roth IRA doesn’t offer upfront tax deductions, but withdrawals in retirement are tax-free.

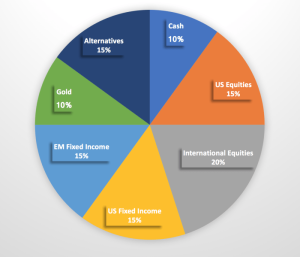

How often should I rebalance my investment portfolio?

Rebalancing frequency depends on your investment strategy and risk tolerance. A common approach is annual rebalancing, but some investors rebalance quarterly or semi-annually.

What are some common tax deductions for investors?

Common deductions include capital losses (up to $3,000 annually), investment expenses (like advisory fees), and potentially certain interest expenses related to investments.

Can I deduct losses from investments against other income?

Yes, you can deduct capital losses against capital gains, and up to $3,000 of net capital losses can be deducted against other income annually. Any excess losses can be carried forward to future tax years.