Navigating the dynamic world of cryptocurrency investments requires careful planning and a thorough understanding of inherent risks. This guide provides a structured approach to making informed decisions, covering crucial aspects from due diligence and diversification strategies to ethical considerations and tax implications. We’ll explore the volatility of the market, the importance of thorough research, and the ethical responsibilities involved in providing and receiving investment advice.

Understanding the potential for both significant returns and substantial losses is paramount. We will examine various risk mitigation techniques, including portfolio diversification and the careful evaluation of cryptocurrency projects. Furthermore, we’ll delve into the legal and regulatory landscape, highlighting the importance of compliance and ethical practices within this rapidly evolving field.

Risks of Cryptocurrency Investment

Investing in cryptocurrencies offers the potential for substantial returns, but it’s crucial to understand the inherent risks before committing your capital. The cryptocurrency market is characterized by extreme volatility, regulatory uncertainty, and a higher-than-average susceptibility to scams. A thorough understanding of these risks is essential for making informed investment decisions.

Volatility and its Impact on Investment Strategies

Cryptocurrency prices are notoriously volatile, experiencing significant price swings in short periods. Factors such as news events, regulatory announcements, technological developments, and market sentiment can all contribute to these fluctuations. This volatility makes it challenging to predict price movements accurately, impacting investment strategies. For example, a sudden market downturn can lead to substantial losses, even for diversified portfolios. Investors need to be prepared for significant price drops and develop strategies that can withstand such volatility, such as dollar-cost averaging or only investing what they can afford to lose.

Regulatory Uncertainty in the Cryptocurrency Space

The regulatory landscape for cryptocurrencies is still evolving globally. Different countries have adopted varying approaches, ranging from outright bans to more permissive regulatory frameworks. This uncertainty creates risks for investors. Changes in regulations can impact the legality and usability of certain cryptocurrencies, potentially affecting their value and accessibility. For instance, a sudden regulatory crackdown could severely limit trading or even lead to the devaluation of specific digital assets.

Scams and Fraudulent Activities in the Cryptocurrency Market

The decentralized nature of cryptocurrencies and the relative anonymity they offer create opportunities for fraudulent activities. Investors need to be wary of scams such as pump-and-dump schemes, phishing attacks, and fake initial coin offerings (ICOs). These scams can result in significant financial losses. Due diligence is paramount; researching projects thoroughly before investing and only using reputable exchanges are vital steps in mitigating this risk.

Comparison of Cryptocurrency Risks with Traditional Investments

Compared to traditional investments like stocks and bonds, cryptocurrencies generally exhibit higher volatility and risk. Stocks and bonds, while subject to market fluctuations, typically have more established regulatory frameworks and a longer track record of performance data. However, traditional investments are not without their own risks; market downturns can affect these asset classes as well. The key difference lies in the magnitude and speed of price movements, which are significantly greater in the cryptocurrency market.

Table of Cryptocurrency Risks and Their Potential Impact

| Risk Category | Specific Risk | Potential Impact on Investors | Mitigation Strategies |

|---|---|---|---|

| Market Volatility | Sudden price drops | Significant capital losses | Diversification, dollar-cost averaging, risk tolerance assessment |

| Regulatory Uncertainty | Changes in legal frameworks | Loss of access to certain cryptocurrencies, devaluation of assets | Staying informed about regulatory developments, geographic diversification |

| Scams and Fraud | Pump-and-dump schemes, phishing attacks | Complete loss of invested capital | Thorough due diligence, using reputable exchanges, strong security practices |

| Technological Risks | Security breaches, software bugs | Loss of funds, data breaches | Using secure wallets, staying updated on security patches |

Due Diligence in Cryptocurrency Investments

Investing in cryptocurrencies can be highly lucrative, but it also carries significant risks. Thorough due diligence is crucial to mitigating these risks and making informed investment decisions. This involves a systematic investigation into various aspects of a cryptocurrency project before committing your funds. Failing to conduct proper due diligence can lead to substantial financial losses.

Verifying the Legitimacy and Track Record of Cryptocurrency Projects

Assessing the legitimacy of a cryptocurrency project requires a multifaceted approach. Begin by scrutinizing the project’s whitepaper, a document outlining its goals, technology, and tokenomics. Look for inconsistencies, unrealistic promises, or a lack of transparency. Next, examine the project’s online presence. A legitimate project will typically have a well-maintained website, active social media channels, and a clear communication strategy.

Investigate whether the project has a history of delivering on its promises. Check for any red flags such as past scams or controversies. Finally, consider the project’s overall reputation within the cryptocurrency community. Negative reviews or widespread skepticism should raise concerns.

Evaluating the Technological Aspects of a Cryptocurrency Project

Understanding the underlying technology is paramount. Examine the cryptocurrency’s source code for vulnerabilities or flaws. While this may require technical expertise, understanding the consensus mechanism (e.g., Proof-of-Work, Proof-of-Stake) and the project’s scalability are crucial. Analyze the project’s technological innovation and its potential to solve real-world problems. Assess the team’s competence in developing and maintaining the technology.

Consider whether the technology is truly novel or simply a rehash of existing ideas. A thorough technical review often requires engaging a qualified expert, especially for complex projects.

Understanding the Team Behind a Cryptocurrency Project

The team behind a cryptocurrency project plays a vital role in its success. Research the team members’ backgrounds, experience, and reputation. Look for evidence of their expertise in relevant fields such as blockchain technology, cryptography, or finance. Transparency is key; a reputable team will openly share information about its members. Investigate whether the team has a proven track record of success in previous ventures.

A strong, experienced, and transparent team significantly increases the project’s credibility and potential for success. Conversely, an anonymous or inexperienced team should raise significant red flags.

Essential Due Diligence Checklist for Cryptocurrency Investors

Before investing in any cryptocurrency, consider the following checklist:

- Thoroughly review the project’s whitepaper for clarity, feasibility, and transparency.

- Analyze the project’s website, social media presence, and online reputation.

- Assess the project’s technological innovation and scalability.

- Investigate the team’s background, experience, and reputation.

- Examine the project’s tokenomics, including token supply, distribution, and utility.

- Evaluate the project’s overall market position and potential for growth.

- Consider the regulatory landscape and potential legal risks.

- Diversify your cryptocurrency portfolio to mitigate risk.

- Only invest what you can afford to lose.

- Consult with a financial advisor before making significant investments.

Diversification Strategies for Cryptocurrency Portfolios

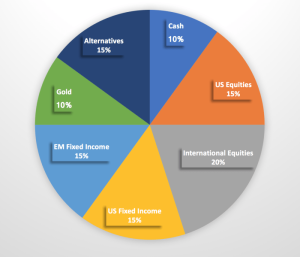

Diversifying your cryptocurrency portfolio is a crucial risk management strategy. Similar to a diversified stock portfolio, spreading your investments across various cryptocurrencies mitigates the impact of any single project’s underperformance. This approach aims to maximize returns while minimizing potential losses. A well-diversified portfolio is more resilient to market volatility and unexpected events.

Benefits of Diversifying Cryptocurrency Investments

Diversification across different cryptocurrency projects offers several key advantages. Firstly, it reduces the risk associated with investing in a single asset. If one cryptocurrency experiences a significant price drop, the losses are cushioned by the performance of other assets in the portfolio. Secondly, diversification allows investors to capitalize on the growth potential of various sectors within the cryptocurrency market.

Finally, diversification helps to balance the volatility inherent in the cryptocurrency market. By investing in a range of projects with different characteristics, investors can smooth out price fluctuations and reduce overall portfolio risk.

Approaches to Diversifying a Cryptocurrency Portfolio

Several approaches exist for diversifying a cryptocurrency portfolio. One common method is diversification by market capitalization. This involves investing in a mix of large-cap, mid-cap, and small-cap cryptocurrencies. Large-cap cryptocurrencies, like Bitcoin and Ethereum, are generally considered less volatile, while smaller-cap cryptocurrencies may offer higher growth potential but come with increased risk. Another strategy is sector diversification.

This involves investing in cryptocurrencies from different sectors, such as DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and metaverse projects. Finally, diversification by technology focuses on investing in projects utilizing different blockchain technologies or consensus mechanisms. This strategy reduces reliance on a single technological approach.

Risk and Reward Comparison of Diversification Strategies

The risk and reward profile of each diversification strategy varies. Diversification by market capitalization generally offers a balance between risk and reward. Large-cap cryptocurrencies provide stability, while smaller-cap investments offer growth potential. Sector diversification can be riskier, as some sectors may experience periods of rapid growth followed by sharp corrections. However, it also allows for exposure to potentially high-growth areas.

Diversification by technology carries a similar risk-reward profile. Investing in projects using newer or less-established technologies may yield higher returns but also involves greater uncertainty.

The Role of Risk Tolerance in Diversification Decisions

An investor’s risk tolerance plays a significant role in shaping their diversification strategy. Conservative investors with low risk tolerance might prefer a portfolio heavily weighted towards large-cap, established cryptocurrencies. These investors prioritize capital preservation over potentially higher returns. More aggressive investors with a higher risk tolerance may choose a portfolio with a larger allocation to smaller-cap and higher-risk cryptocurrencies, aiming for potentially greater returns.

Understanding and accepting one’s risk tolerance is paramount to building a suitable portfolio.

Sample Diversified Cryptocurrency Portfolio (Moderate Risk Tolerance)

This sample portfolio illustrates a moderately diversified approach suitable for an investor with moderate risk tolerance. It balances stability with growth potential.

| Cryptocurrency | Allocation (%) | Rationale | Category |

|---|---|---|---|

| Bitcoin (BTC) | 40 | Established, market leader, relatively stable | Large-Cap |

| Ethereum (ETH) | 25 | Smart contract platform, widely adopted | Large-Cap |

| Solana (SOL) | 15 | High-performance blockchain, growing ecosystem | Mid-Cap |

| Aave (AAVE) | 10 | Decentralized lending platform, exposure to DeFi | Mid-Cap, DeFi |

| Polygon (MATIC) | 10 | Scalability solution for Ethereum, growing adoption | Mid-Cap, Layer-2 |

Investment Advice

Providing cryptocurrency investment advice carries significant ethical responsibilities. The volatile nature of the market and the potential for substantial financial losses necessitate a high degree of integrity and transparency from advisors. Failing to uphold these standards can lead to serious consequences for both the advisor and their clients.

Ethical Responsibilities of Cryptocurrency Investment Advisors

Individuals offering cryptocurrency investment advice have a duty to act in the best interests of their clients. This includes prioritizing client needs over personal gain, providing accurate and unbiased information, and avoiding conflicts of interest. Advisors should always be mindful of the potential for manipulation and ensure that their recommendations are based on sound analysis and due diligence, rather than speculative trends or personal biases.

Furthermore, they should maintain client confidentiality and respect data privacy regulations.

Potential Conflicts of Interest in Cryptocurrency Investment Advice

Several potential conflicts of interest can arise in the cryptocurrency investment advice landscape. For example, an advisor might receive commissions or incentives for recommending specific investments, creating a bias towards those investments regardless of their suitability for the client. Similarly, an advisor who holds a personal stake in a particular cryptocurrency might be tempted to recommend it to clients even if it isn’t the most appropriate choice for their portfolio.

Another conflict arises when an advisor provides advice on multiple cryptocurrencies without disclosing potential overlaps or interdependencies, potentially leading to undue risk concentration for the client. Finally, an advisor accepting payment linked directly to investment performance creates an incentive to take on excessive risk, prioritizing short-term gains over long-term client well-being.

Transparency and Disclosure in Cryptocurrency Investment Advice

Transparency and full disclosure are paramount in building trust and ensuring ethical conduct. Advisors must clearly disclose any potential conflicts of interest, including financial incentives, personal holdings, or affiliations with cryptocurrency projects. They should also clearly state the basis of their recommendations, including the methodologies used for analysis and the limitations of their advice. Any assumptions made in the analysis should be explicitly stated, and the potential risks associated with the recommended investments must be clearly communicated to the client.

Clients need to understand the limitations of the advice, such as its reliance on historical data and the inherent unpredictability of the cryptocurrency market.

Best Practices for Ensuring Accuracy and Reliability

To ensure the accuracy and reliability of cryptocurrency investment advice, advisors should adhere to rigorous research methodologies. This involves conducting thorough due diligence on all recommended investments, verifying information from multiple reputable sources, and staying updated on market trends and regulatory changes. Regularly reviewing and updating investment strategies based on new information is crucial. Advisors should also maintain detailed records of their research, recommendations, and client interactions to demonstrate accountability and transparency.

Finally, seeking independent verification of data and analyses from credible sources adds another layer of reliability to the advice. For instance, referencing data from established cryptocurrency exchanges or blockchain explorers helps ensure accuracy.

Code of Conduct for Cryptocurrency Investment Advisors

The importance of a robust code of conduct cannot be overstated. Here are key principles for individuals offering cryptocurrency investment advice:

- Prioritize Client Interests: Always act in the best interests of your clients, placing their needs above your own personal gain.

- Full Disclosure: Disclose all potential conflicts of interest, financial incentives, and personal holdings related to cryptocurrency investments.

- Accurate Information: Provide only accurate, unbiased, and well-researched information, clearly outlining the limitations of your advice.

- Due Diligence: Conduct thorough due diligence on all recommended investments, verifying information from multiple reliable sources.

- Transparency: Maintain transparent and clear communication with clients throughout the advisory process.

- Confidentiality: Protect client confidentiality and adhere to all relevant data privacy regulations.

- Continuing Education: Stay up-to-date on market trends, regulatory changes, and best practices in cryptocurrency investment.

- Record Keeping: Maintain detailed records of research, recommendations, and client interactions.

Understanding Cryptocurrency Market Trends

The cryptocurrency market is notoriously volatile, influenced by a complex interplay of factors. Understanding these influences is crucial for navigating the market effectively and making informed investment decisions. This section will explore the key drivers of cryptocurrency market trends, methods for interpreting market data, and techniques for identifying potential trading opportunities.

Factors Influencing Cryptocurrency Market Trends

Regulatory changes, technological advancements, and macroeconomic conditions significantly impact cryptocurrency prices. Government regulations, such as bans or stringent licensing requirements, can drastically alter investor sentiment and market liquidity. Technological breakthroughs, like the development of new consensus mechanisms or scalability solutions, can attract investment and drive price appreciation. Meanwhile, broader economic factors, such as inflation rates, interest rate changes, and global economic uncertainty, influence investor risk appetite and capital flows into the cryptocurrency market.

For example, periods of high inflation often see increased interest in cryptocurrencies as a hedge against inflation.

Interpreting Cryptocurrency Market Data

Price charts and trading volume provide valuable insights into market sentiment and potential trends. Price charts visually represent the historical price movements of a cryptocurrency, allowing investors to identify patterns, support and resistance levels, and potential trend reversals. Trading volume indicates the level of activity in the market, with higher volumes often suggesting stronger price movements. For instance, a sustained increase in price accompanied by high trading volume suggests a strong upward trend, while a price drop with high volume could indicate a significant sell-off.

Conversely, low volume during a price movement may suggest a weaker trend and potential for reversal.

Examples of Historical Cryptocurrency Market Trends

The 2017 Bitcoin bull run, driven by increasing mainstream adoption and speculative investment, saw Bitcoin’s price surge to almost $20,000. This was followed by a significant correction in 2018, largely attributed to regulatory uncertainty and a general market downturn. More recently, the rise of decentralized finance (DeFi) in 2020-2021 led to a surge in the prices of various altcoins, highlighting the impact of technological innovation on market trends.

These examples illustrate the cyclical nature of the cryptocurrency market and the importance of understanding the underlying drivers of price movements.

Utilizing Technical Analysis for Trading Opportunities

Technical analysis involves using historical price and volume data to identify patterns and predict future price movements. Indicators such as moving averages, relative strength index (RSI), and MACD can help identify potential buy or sell signals. For example, a bullish crossover of moving averages might signal a potential upward trend, while an RSI reading above 70 might suggest the market is overbought and prone to a correction.

However, it’s crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis and other forms of due diligence.

Interplay of Market Forces Influencing Cryptocurrency Prices

Imagine a scale balancing investor sentiment (represented by a weight on one side) against regulatory pressures and technological advancements (represented by weights on the other side). Positive investor sentiment, driven by factors like media hype or technological breakthroughs, pushes the scale upwards, increasing prices. Conversely, negative sentiment, perhaps fueled by regulatory crackdowns or security breaches, pulls the scale downwards, causing prices to fall.

Macroeconomic factors act as a counterweight, shifting the balance based on overall economic conditions. A strong economy might support higher prices, while economic uncertainty could cause a decline. The interplay of these forces determines the overall equilibrium point, representing the current market price. A sudden shift in any of these weights (for example, a major regulatory announcement) will disrupt the balance and lead to a price adjustment.

Tax Implications of Cryptocurrency Investments

The tax treatment of cryptocurrency investments varies significantly depending on your location and the specific nature of your transactions. Understanding these implications is crucial for responsible cryptocurrency investing and avoiding potential legal and financial penalties. This section will Artikel the key tax considerations for buying, selling, and trading cryptocurrencies, focusing on common tax types and providing illustrative examples.

Capital Gains Tax on Cryptocurrency Transactions

Capital gains tax applies when you sell a cryptocurrency for a profit. The profit, calculated as the difference between the selling price and the purchase price (adjusted for any fees), is subject to taxation. The tax rate depends on your jurisdiction and the length of time you held the cryptocurrency (short-term vs. long-term capital gains). For example, in the United States, short-term capital gains (assets held for less than one year) are taxed at your ordinary income tax rate, while long-term capital gains rates are generally lower.

Other countries may have different holding periods and tax brackets. It’s essential to consult your local tax authority for precise details.

Income Tax and Cryptocurrency Trading

If you regularly trade cryptocurrencies, your profits might be considered taxable income rather than capital gains. This is particularly relevant for those who actively engage in day trading or other frequent transactions. Tax authorities often scrutinize the frequency and volume of trades to determine whether the activity constitutes a business or a mere investment. If deemed a business, profits are taxed as ordinary income, often at a higher rate than long-term capital gains.

For instance, a trader making numerous trades daily might find their cryptocurrency profits taxed as business income in jurisdictions that classify such activity as a trade.

Calculating Tax Liability: An Example

Let’s illustrate with a simple example. Suppose you bought 1 Bitcoin (BTC) for $10,000 and sold it a year later for $20,000. Ignoring fees, your profit is $10,000. In the US, this would be considered a long-term capital gain and taxed at the applicable long-term capital gains rate for your income bracket. However, if you had bought and sold the BTC multiple times within the same year, the profits might be taxed at your ordinary income tax rate.

Comparison with Traditional Investments

The tax treatment of cryptocurrency differs from traditional investments in several key ways. For instance, while dividends from stocks are often taxed separately, cryptocurrency profits are generally taxed as either capital gains or income, depending on the circumstances. Furthermore, the decentralized and often anonymous nature of cryptocurrency transactions can make tracking and reporting gains more complex than with traditional, broker-managed investments.

Many jurisdictions are still developing specific guidelines for cryptocurrency taxation, leading to inconsistencies and ongoing changes in regulations.

Tax Implications Summary Table

| Activity | Tax Type (Example: US) | Tax Rate (Example: US) | Notes |

|---|---|---|---|

| Buying Cryptocurrency | No immediate tax implication | N/A | Cost basis is established for future calculations |

| Selling Cryptocurrency (Long-term) | Long-term Capital Gains | Varies by income bracket | Held for over one year (US) |

| Selling Cryptocurrency (Short-term) | Short-term Capital Gains | Ordinary income tax rate | Held for less than one year (US) |

| Trading Cryptocurrency (Frequent) | Ordinary Income | Ordinary income tax rate | May be considered business income |

Successfully investing in cryptocurrencies demands a proactive and informed approach. By understanding the risks, conducting thorough due diligence, employing effective diversification strategies, and adhering to ethical principles, investors can navigate the complexities of this market and potentially achieve their financial goals. Remember, thorough research and a cautious approach are key to mitigating risks and maximizing potential returns in the dynamic world of cryptocurrency investment.

FAQ Section

What is the best cryptocurrency to invest in?

There is no single “best” cryptocurrency. Investment decisions should be based on thorough research, risk tolerance, and individual financial goals. Diversification across various cryptocurrencies is often recommended.

How can I protect myself from cryptocurrency scams?

Be wary of unsolicited investment offers, verify the legitimacy of projects and platforms independently, and never invest more than you can afford to lose. Use reputable exchanges and wallets.

Are cryptocurrency investments insured?

Unlike traditional bank deposits, cryptocurrency investments are generally not insured by government agencies. The risk of loss is borne solely by the investor.

What are the tax implications of cryptocurrency staking rewards?

Staking rewards are generally considered taxable income in most jurisdictions. Consult a tax professional for specific guidance based on your location and circumstances.