With Short-Term Investment Strategies at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling casual formal language style filled with unexpected twists and insights.

Short-term investments offer lucrative opportunities for quick gains, but navigating the risks requires a strategic approach. Let’s delve into the world of short-term investment strategies to uncover the keys to success.

Short-Term Investment Strategies

Short-term investment strategies involve investing in financial instruments with the intention of profiting in a relatively short period, typically less than one year. These strategies are usually more focused on capitalizing on short-term market fluctuations rather than long-term growth.

Examples of Short-Term Investment Options

- Stock Trading: Buying and selling shares of publicly traded companies in the stock market.

- Forex Trading: Trading currencies in the foreign exchange market to take advantage of fluctuations in exchange rates.

- Short-Term Bonds: Investing in bonds with shorter maturity periods to earn interest income.

- Commodity Trading: Buying and selling commodities like gold, silver, or oil for short-term gains.

Potential Risks Associated with Short-Term Investments

While short-term investments offer the potential for quick profits, they also come with certain risks:

- Market Volatility: Short-term investments are more susceptible to market fluctuations, which can result in sudden losses.

- Liquidity Risk: Some short-term investments may lack liquidity, making it difficult to sell them quickly without incurring significant losses.

- Interest Rate Risk: Changes in interest rates can impact the value of short-term investments, especially bonds.

- Timing Risk: Timing the market correctly is crucial for short-term investments, and mistimed decisions can lead to losses.

Investment Advice

Seeking professional investment advice is crucial when making decisions about your finances. Investment advisors can provide valuable insights and expertise that can help you navigate the complex world of investments.

Importance of Seeking Professional Advice

- Professional investment advice can help you create a personalized investment strategy based on your financial goals and risk tolerance.

- Advisors can provide guidance on selecting the right investment options that align with your objectives.

- They can offer valuable market insights and help you make informed decisions to maximize returns while managing risks.

Role of Investment Advisors

- Investment advisors play a crucial role in providing personalized advice tailored to your unique financial situation.

- They can help you diversify your portfolio effectively to mitigate risks and optimize returns.

- Advisors also stay updated on market trends and can assist you in adjusting your investment strategy accordingly.

Investment Banking

Investment banking plays a crucial role in the financial sector, primarily focusing on providing financial advisory services, underwriting securities, and facilitating mergers and acquisitions.

Key Functions of Investment Banking

- Advisory Services: Investment banks offer advice to clients on various financial matters, such as mergers, acquisitions, and restructuring.

- Underwriting: Investment banks help companies raise capital by underwriting new debt or equity securities.

- Trading and Market Making: Investment banks engage in trading activities in financial markets and often serve as market makers.

- Asset Management: Some investment banks offer asset management services to institutional and high-net-worth clients.

Services Offered by Investment Banks

- Initial Public Offerings (IPOs): Investment banks assist companies in going public by managing the IPO process.

- Private Placements: Investment banks help companies raise capital through private offerings to institutional investors.

- Merger and Acquisition (M&A) Advisory: Investment banks provide advisory services to clients involved in mergers, acquisitions, and divestitures.

- Debt and Equity Financing: Investment banks help companies raise capital through debt or equity financing.

Differences between Investment Banking and Commercial Banking

- Focus: Investment banks primarily focus on capital markets, advisory services, and trading, while commercial banks focus on traditional banking services such as deposits, loans, and everyday banking needs.

- Risk: Investment banks typically take on higher levels of risk due to their involvement in trading and underwriting activities, whereas commercial banks focus on managing risk in their lending and deposit-taking operations.

- Regulation: Investment banks are subject to different regulatory frameworks compared to commercial banks, as they engage in more complex and specialized financial activities.

- Client Base: Investment banks cater to corporations, institutional investors, and high-net-worth individuals, while commercial banks serve a broader range of customers, including retail clients and small businesses.

Investment Horizon

Investment horizon refers to the length of time an investor plans to hold an investment before selling it. It is a crucial factor in determining the appropriate investment strategy and risk tolerance level for an individual.Investment horizon impacts investment decisions in various ways. A longer investment horizon allows investors to take on more risk and potentially earn higher returns, as they have more time to recover from market fluctuations.

On the other hand, a shorter investment horizon may require a more conservative approach to avoid losses due to market volatility.

Examples of Different Investment Horizons

- Short-term (less than one year): Investors with a short-term horizon typically focus on liquid assets like cash, money market funds, or short-term bonds. These investments are less volatile and provide quick access to funds.

- Medium-term (one to five years): Investors with a medium-term horizon may consider a mix of stocks and bonds to balance risk and return. They have the flexibility to ride out short-term market fluctuations.

- Long-term (five years or more): Long-term investors can afford to take on more risk by investing in equities or real estate. They have the advantage of compounding returns over time and can weather market downturns.

Investment Opportunities

When looking for investment opportunities, it’s essential to identify various options available in the market. By recognizing profitable opportunities and following some key tips, you can maximize returns on your investments.

Types of Investment Opportunities

- Stock Market: Investing in individual stocks or exchange-traded funds (ETFs) can provide opportunities for growth.

- Real Estate: Purchasing properties for rental income or appreciation can be a lucrative investment opportunity.

- Bonds: Investing in government or corporate bonds can offer fixed income and stability in a portfolio.

Recognizing Profitable Investment Opportunities

- Conduct thorough research on the market and specific investment options.

- Consider the potential for growth and return on investment in the short term.

- Look for opportunities that align with your risk tolerance and investment goals.

Tips for Maximizing Returns

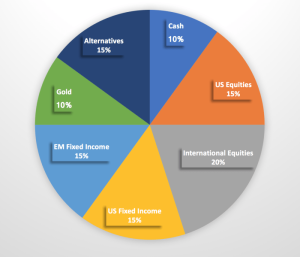

- Diversify your portfolio to spread risk and take advantage of various investment opportunities.

- Regularly review and adjust your investments based on market trends and performance.

- Consider seeking advice from financial professionals to make informed investment decisions.

Investment Strategy

Having a well-defined investment strategy is crucial for achieving financial goals and maximizing returns on investments. It provides a roadmap for making informed decisions, managing risks, and staying focused on long-term objectives.

Types of Investment Strategies

- Growth Strategy: Focuses on investing in companies with high growth potential, aiming for capital appreciation over time.

- Value Strategy: Involves seeking undervalued assets or stocks that have the potential to increase in value over time.

- Income Strategy: Emphasizes generating a steady stream of income through investments like dividend-paying stocks, bonds, or real estate.

Tips for Creating a Personalized Investment Strategy

- Assess Your Risk Tolerance: Understand how much risk you are willing to take and align your investments accordingly.

- Set Financial Goals: Define clear objectives such as retirement savings, buying a house, or funding education, and tailor your strategy to meet these goals.

- Diversify Your Portfolio: Spread investments across different asset classes to reduce risk and improve overall returns.

- Review and Rebalance: Regularly review your portfolio performance and make adjustments to ensure it remains aligned with your goals and risk tolerance.

In conclusion, Short-Term Investment Strategies provide a dynamic way to grow your wealth rapidly, but understanding the risks and rewards is crucial. By crafting a well-defined strategy and staying informed, investors can make the most of short-term opportunities in the ever-changing market.

FAQ Section

What are the key benefits of short-term investment strategies?

Short-term investment strategies offer the potential for quick returns and flexibility to capitalize on market trends.

How can I mitigate the risks associated with short-term investments?

Diversifying your investment portfolio and staying informed about market conditions can help reduce the risks of short-term investments.

Is it possible to achieve long-term financial goals through short-term investment strategies?

While short-term investments are more focused on immediate gains, they can complement a long-term investment plan by providing liquidity and opportunities for growth.