Embark on a journey to financial success with the right Investment Strategy for College Savings. Discover the key elements to secure your child’s future education without financial stress.

Learn how to navigate the complex world of investments with confidence and clarity, ensuring your savings grow steadily over time.

Introduction to Investment Strategy for College Savings

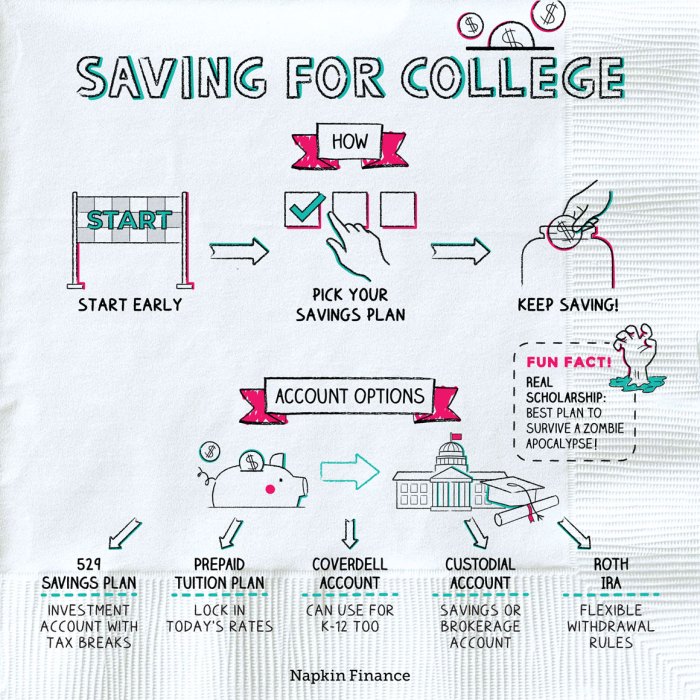

When it comes to saving for college, having a dedicated investment strategy is crucial for ensuring that you meet your financial goals. By carefully planning and implementing an investment strategy tailored specifically for college savings, you can maximize your returns and secure a brighter future for your child’s education.

Importance of Starting Early

Starting early with a well-thought-out investment plan can make a significant difference in the amount of savings you accumulate over time. The power of compound interest allows your savings to grow exponentially, giving you a substantial financial advantage when it’s time for your child to go to college.

Benefits of a Tailored Strategy

Having a specific investment strategy tailored to college savings allows you to align your financial goals with the needs of your child’s education. By considering factors such as risk tolerance, time horizon, and college costs, you can create a plan that is optimized for achieving your desired outcome.

Types of Investment Accounts for College Savings

When it comes to saving for college, there are several types of investment accounts that can help you reach your goals. Each type of account comes with its own set of tax advantages, limitations, flexibility, and restrictions. Understanding the differences between these accounts can help you make an informed decision about how to save for your child’s education.

529 Plans

- 529 plans are tax-advantaged savings plans specifically designed for educational expenses.

- Contributions to a 529 plan grow tax-deferred and withdrawals are tax-free when used for qualified education expenses.

- Each state sponsors its own 529 plan, offering different investment options and tax benefits.

- Some 529 plans also allow for high contribution limits, making them a popular choice for college savings.

Coverdell ESAs

- Coverdell Education Savings Accounts (ESAs) are another tax-advantaged option for college savings.

- Contributions to a Coverdell ESA grow tax-free and withdrawals are tax-free when used for qualified education expenses.

- Coverdell ESAs have lower contribution limits compared to 529 plans, but they offer more investment flexibility.

- These accounts can also be used for K-12 education expenses in addition to higher education costs.

UTMA/UGMA Accounts

- UTMA (Uniform Transfers to Minors Act) and UGMA (Uniform Gifts to Minors Act) accounts are custodial accounts that allow minors to own assets.

- Contributions to UTMA/UGMA accounts are irrevocable gifts to the child and can be used for any purpose, not just education.

- Income generated by these accounts may be subject to the “kiddie tax” if it exceeds certain limits.

- Once the child reaches the age of majority, they gain control of the account and can use the funds as they see fit.

Factors to Consider When Designing an Investment Strategy

When crafting an investment strategy for college savings, there are several key factors that should be taken into account to ensure the best possible outcomes for the future educational needs of your child.

Risk Tolerance, Investment Timeline, and Savings Goals

- Understanding your risk tolerance is crucial as it determines the level of volatility your investments can withstand. Higher risk investments may offer greater returns but also come with increased potential for losses.

- Your investment timeline plays a significant role in determining the appropriate investment strategy. The longer the timeline, the more aggressive you can afford to be with your investments, as you have more time to recover from potential losses.

- Setting clear savings goals is essential to guide your investment decisions. Knowing how much you need to save and by when can help you tailor your investment strategy to meet those specific financial targets.

Impact of Inflation and Market Fluctuations

- Inflation can erode the purchasing power of your college savings over time. It is crucial to choose investments that have the potential to outpace inflation to ensure that your savings retain their value and continue to grow.

- Market fluctuations can impact the performance of your investments. Diversification, discussed in the next section, can help mitigate the effects of market volatility and reduce the overall risk in your investment portfolio.

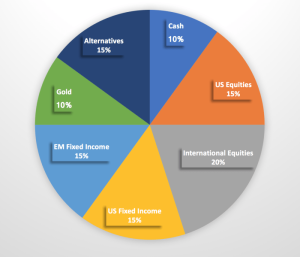

Importance of Diversification

Diversification involves spreading your investments across different asset classes, industries, and geographic regions to reduce the impact of market fluctuations on your overall portfolio. By diversifying, you can help protect your college savings from significant losses that may occur in a single investment or sector. It is a fundamental strategy to manage risk and enhance the long-term growth potential of your investments.

Investment Options for College Savings

When saving for college, it’s crucial to consider various investment options to help grow your funds over time. Let’s explore different types of investments and how they can impact your college savings.

Stocks

Stocks represent ownership in a company and offer the potential for high returns. However, they also come with higher risk due to market volatility. It’s essential to diversify your stock portfolio to mitigate risk and maximize potential gains.

Bonds

Bonds are considered a safer investment option compared to stocks, providing a fixed income over a specified period. While they offer more stability, the returns may be lower than what stocks can potentially yield. Bonds can be a valuable addition to a college savings portfolio to balance risk.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer instant diversification and are managed by professionals. However, they come with management fees that can impact overall returns.

ETFs

Exchange-traded funds (ETFs) are similar to mutual funds but trade on stock exchanges like individual stocks. They provide diversification and flexibility with lower expense ratios compared to mutual funds. ETFs can be a cost-effective option for college savings investments.

Balance Risk and Return

When selecting investments for college savings, it’s essential to strike a balance between risk and return. Higher-risk investments like stocks can offer greater potential returns but also come with increased volatility. Consider your risk tolerance, investment timeline, and financial goals when designing your investment strategy for college savings.

Working with Investment Advisors for College Savings

Investment advisors play a crucial role in helping families develop a solid college savings plan. Their expertise and knowledge of financial markets can guide families in making informed decisions to grow their savings effectively.

Choosing a Reputable Investment Advisor for College Savings

- Look for advisors with relevant experience in college savings planning.

- Check their credentials and certifications to ensure they are qualified to provide financial advice.

- Ask for referrals from friends or family members who have successfully saved for college with the help of an advisor.

- Consider meeting with multiple advisors to compare their recommendations and communication styles before making a decision.

Importance of Regular Reviews and Adjustments with an Advisor

Regular reviews with an investment advisor are crucial to ensure that your college savings plan stays on track. Advisors can help you assess the performance of your investments, make necessary adjustments based on market conditions, and ensure that you are taking advantage of all available opportunities to maximize your savings.

Investment Strategies for Different College Time Horizons

When saving for college, it’s important to consider the time horizon you are working with. Different timeframes require different investment strategies to maximize growth and minimize risk. Let’s explore specific investment strategies for short-term, medium-term, and long-term college savings goals.

Short-Term College Savings Goals

For short-term college savings goals (less than 5 years), it’s essential to prioritize capital preservation over aggressive growth. Consider low-risk investment options such as high-yield savings accounts, money market funds, or short-term bonds. These investments provide liquidity and stability, ensuring that your savings are readily available when needed for tuition payments.

Medium-Term College Savings Goals

When saving for college within a 5 to 10-year timeframe, you can take on slightly more risk to pursue higher returns. Consider a mix of stocks and bonds in your investment portfolio to balance growth potential with stability. Diversification is key to mitigate risk and capture market opportunities. Rebalance your portfolio periodically to maintain your target asset allocation.

Long-Term College Savings Goals

For long-term college savings goals (over 10 years), you have the flexibility to invest more aggressively for potential higher returns. Emphasize growth-oriented investments such as stocks, mutual funds, or exchange-traded funds (ETFs). While these investments carry more risk, they also offer the potential for significant growth over time. Consider a mix of domestic and international investments to diversify your portfolio and capture global market opportunities.As the college time horizon approaches, it’s important to make adjustments to your investment strategy.

For short-term goals, gradually shift towards more conservative investments to safeguard your capital. For medium-term goals, consider reducing risk exposure by reallocating assets into more stable investments. For long-term goals, periodically review and adjust your portfolio to ensure alignment with your risk tolerance and financial goals.By tailoring your investment strategy to the specific time horizon of your college savings goal, you can optimize your portfolio’s performance and achieve your financial objectives effectively.

Comparing Investment Strategies for College Savings

When it comes to saving for college, choosing the right investment strategy is crucial. Let’s compare conservative, moderate, and aggressive investment strategies for college savings to help you make an informed decision.

Conservative Investment Strategy

A conservative investment strategy focuses on preserving capital and minimizing risk. This approach typically involves investing in low-risk assets such as bonds, money market funds, and certificates of deposit. While potential returns are lower compared to other strategies, the risk of losing money is also reduced, making it a suitable option for those with a low risk tolerance.

Moderate Investment Strategy

A moderate investment strategy strikes a balance between risk and return. This approach involves investing in a mix of assets, including stocks, bonds, and mutual funds. While there is a higher level of risk compared to a conservative strategy, the potential for returns is also greater. Moderate strategies are suitable for investors willing to take on some risk to achieve higher growth potential.

Aggressive Investment Strategy

An aggressive investment strategy focuses on maximizing returns by taking on higher levels of risk. This approach typically involves investing a large portion of the portfolio in stocks and other high-risk assets. While the potential for returns is significant, there is also a higher risk of losing money. Aggressive strategies are suitable for investors with a long time horizon and a high risk tolerance.

In conclusion, mastering the art of Investment Strategy for College Savings is the key to unlocking a brighter future for your child’s education. Start planning today to reap the benefits tomorrow.

Q&A

What are the different types of investment accounts suitable for college savings?

Common types include 529 plans, Coverdell ESAs, or UTMA/UGMA accounts, each with unique tax advantages and limitations.

How do I choose the right investment advisor for college savings?

Look for a reputable advisor with experience in college savings planning and ensure they align with your financial goals.

What factors should I consider when designing an investment strategy for college savings?

Key factors to consider include risk tolerance, investment timeline, and savings goals to tailor your strategy effectively.