Exploring the distinctions between Investment Advisors and Financial Planners, this introduction sets the stage for an insightful discussion that sheds light on their unique roles and responsibilities, educational requirements, and services provided.

It also delves into the focus areas of these professionals, offering readers a comprehensive overview of what to expect in the following sections.

Investment Advisor vs Financial Planner

When it comes to managing finances, the roles of an investment advisor and a financial planner may seem similar, but they have distinct differences in their focus and services offered.

Key Differences in Roles

- Investment Advisor: Primarily focuses on managing and recommending investment options to help clients grow their wealth.

- Financial Planner: Offers comprehensive financial guidance, including budgeting, retirement planning, insurance needs, and investment strategies.

Educational Requirements

- Investment Advisor: Typically requires a bachelor’s degree in finance, economics, or a related field. Often need to pass licensing exams like the Series 7 and Series 66.

- Financial Planner: May hold a Certified Financial Planner (CFP) designation, requiring a bachelor’s degree, passing the CFP exam, and completing relevant work experience.

Services Offered

- Investment Advisor: Provides investment advice, portfolio management, and helps clients make informed decisions about buying and selling securities.

- Financial Planner: Offers a holistic approach to financial planning, including retirement planning, tax strategies, estate planning, and risk management.

Focus Areas

- Investment Advisor: Focuses primarily on maximizing returns on investments, managing risk, and staying up-to-date on market trends.

- Financial Planner: Focuses on creating a comprehensive financial plan tailored to the client’s goals, considering all aspects of their financial life.

Investment Advice

Investment advice refers to recommendations provided by professionals regarding the best ways to invest money in order to achieve financial goals.Seeking professional investment advice is crucial for individuals looking to grow their wealth, plan for retirement, or navigate complex financial markets. A professional advisor can offer personalized guidance based on an individual’s financial situation, risk tolerance, and investment objectives.

Importance of Seeking Professional Investment Advice

- Helps in creating a well-rounded investment portfolio

- Ensures alignment of investments with financial goals

- Provides expertise in navigating market fluctuations

- Assists in managing risk and maximizing returns

Examples of Situations Where Investment Advice Can Be Beneficial

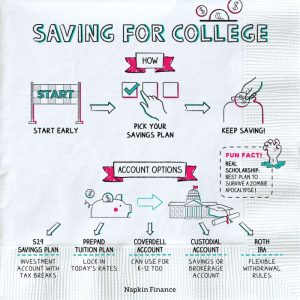

- Planning for retirement and determining the right savings strategy

- Deciding on investment options for education funds

- Managing windfall gains or inheritance wisely

- Handling complex financial situations such as tax implications of investments

Risks Associated with Not Seeking Investment Advice

- Making uninformed investment decisions leading to potential losses

- Missing out on opportunities for growth and wealth accumulation

- Exposure to higher levels of risk due to lack of diversification

- Lack of proper financial planning leading to inadequate savings for future goals

Investment Banking

Investment banking plays a crucial role in the financial industry, acting as a bridge between corporations and investors. It involves providing financial advisory services, underwriting securities, facilitating mergers and acquisitions, and managing assets.

Role of Investment Banking

Investment banking differs from traditional banking by focusing on raising capital for companies, advising on mergers and acquisitions, and providing strategic financial advice. Unlike traditional banks that mainly deal with deposits and loans, investment banks work with corporations, governments, and other entities to raise funds through the issuance of securities.

Services Offered by Investment Banks

Investment banks offer a wide range of services, including mergers and acquisitions advisory, underwriting of securities, asset management, trading of derivatives and securities, and research. They help companies raise capital through public offerings or private placements, provide strategic advice on corporate finance matters, and assist in complex financial transactions.

Career Paths in Investment Banking

Career opportunities in investment banking include roles such as investment banking analyst, associate, vice president, and managing director. These positions involve financial analysis, client relationship management, deal execution, and strategic decision-making. Many professionals in investment banking eventually pursue advanced degrees or certifications to further their careers and expertise in the field.

Investment Horizon

Investment horizon refers to the length of time an investor expects to hold an investment before needing to access the funds. It is a crucial factor in investment planning as it helps determine the appropriate investment strategies and asset allocation.

Significance of Investment Horizon

- Longer investment horizons allow investors to take on more risk and potentially earn higher returns.

- Shorter investment horizons may require a more conservative approach to protect capital.

- Understanding your investment horizon helps in setting realistic financial goals and aligning them with your risk tolerance.

Varying Investment Horizon Based on Financial Goals

- For long-term goals like retirement, investors can afford to take on more risk and invest in growth-oriented assets.

- Short-term goals such as buying a house may require a more conservative approach with a focus on capital preservation.

Aligning Investment Horizon with Risk Tolerance

- Investors with longer investment horizons can afford to take on more risk as they have time to recover from market fluctuations.

- Shorter investment horizons may necessitate a more conservative approach to protect against market volatility.

Impact of Investment Horizon on Portfolio Diversification

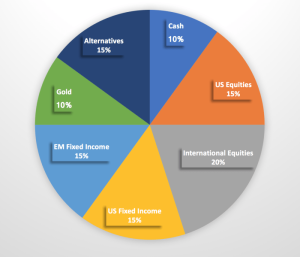

- Longer investment horizons allow for greater portfolio diversification across asset classes to potentially enhance returns and reduce risk.

- Shorter investment horizons may require a more focused and conservative approach to limit exposure to market fluctuations.

Investment Opportunities

When looking for investment opportunities, investors have a wide range of options to choose from. It is essential to evaluate each opportunity carefully to maximize returns and minimize risks.

Types of Investment Opportunities

- Stocks: Investing in shares of publicly traded companies.

- Bonds: Purchasing debt securities issued by governments or corporations.

- Real Estate: Buying properties for rental income or capital appreciation.

- Mutual Funds: Pooling money with other investors to invest in a diversified portfolio.

- Commodities: Trading in physical goods like gold, oil, or agricultural products.

Factors to Consider when Evaluating Investment Opportunities

- Economic Conditions: Assess how the economy might impact the investment.

- Risk Tolerance: Determine how much risk you are willing to take on for potential returns.

- Liquidity: Consider how easily you can buy or sell the investment.

- Time Horizon: Evaluate how long you plan to hold the investment.

Spotting Potential Investment Opportunities

- Market Research: Stay informed about market trends and industry developments.

- Technical Analysis: Use charts and indicators to identify patterns and potential entry points.

- Fundamental Analysis: Analyze financial statements and economic indicators to assess the investment’s value.

Tips for Maximizing Returns on Investment Opportunities

- Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk.

- Regularly Review Your Investments: Monitor performance and make adjustments as needed.

- Stay Informed: Keep up-to-date with market news and developments that may impact your investments.

- Consult with Professionals: Seek advice from financial planners or investment advisors to make informed decisions.

Investment Strategy

Investment strategy is a plan or approach to guide an investor’s decisions on where to allocate their capital in order to achieve their financial goals. It plays a crucial role in wealth management as it helps investors maximize returns while managing risks effectively.

Different Investment Strategies

- Growth Investing: This strategy focuses on investing in companies with high growth potential, even if their current stock prices seem overvalued. The goal is to benefit from capital appreciation as the company grows.

- Value Investing: Value investors look for undervalued stocks that are trading below their intrinsic value. The idea is to buy these stocks at a discount and wait for the market to recognize their true worth, leading to potential profits.

- Income Investing: Income investors seek out investments that generate regular income, such as dividend-paying stocks, bonds, or real estate investment trusts (REITs). The primary objective is to create a steady stream of cash flow.

Role of Risk Management

Risk management is an integral part of developing an investment strategy as it helps investors protect their capital from potential losses. By diversifying their portfolio, setting stop-loss orders, and conducting thorough research, investors can mitigate risks and safeguard their investments.

Successful Investment Strategies

One example of a successful investment strategy is Warren Buffett’s value investing approach, where he focuses on buying undervalued companies with strong fundamentals and holding them for the long term.

Another renowned investor, Peter Lynch, employed a growth investing strategy during his tenure at Fidelity Magellan Fund, achieving impressive returns by investing in companies with high growth potential.

In conclusion, the discussion on Investment Advisor vs Financial Planner highlights the crucial disparities between the two professions, emphasizing the importance of seeking expert advice when navigating the complex world of investments and financial planning.

Detailed FAQs

What are the main differences between an Investment Advisor and a Financial Planner?

The key distinctions lie in their roles, educational requirements, services offered, and focus areas. An Investment Advisor focuses more on managing investments, while a Financial Planner offers holistic financial planning services.

Why is professional investment advice important?

Professional advice can provide tailored strategies, help navigate risks, and optimize investment decisions based on individual financial goals and risk tolerance.

How can one align their investment horizon with risk tolerance?

Aligning investment horizon with risk tolerance involves understanding one’s financial goals, time horizon, and risk appetite to create a diversified portfolio that balances risk and returns effectively.

What are some common types of investment opportunities available to investors?

Investors can explore options like stocks, bonds, real estate, mutual funds, and ETFs, each with varying levels of risk and potential returns.

How important is risk management in developing an investment strategy?

Risk management plays a crucial role in safeguarding investments, ensuring capital preservation, and optimizing returns by strategically managing potential risks associated with different investment vehicles.