Embark on a journey through the world of Global Investment Strategies, where the key to success lies in diversification and understanding market trends.

Delve deeper into the realm of different investment strategies and their impact on global financial decisions.

Global Investment Strategies

Investing globally opens up a world of opportunities for investors, allowing them to diversify their portfolios and potentially maximize returns. Understanding different types of global investment strategies, the importance of diversification, the impact of geopolitical events, and how global economic trends shape investment decisions is crucial for successful investing.

Types of Global Investment Strategies

- Passive Investing: Involves buying and holding a diversified portfolio of assets to track a specific index, such as the S&P 500.

- Active Investing: Involves actively buying and selling assets in an attempt to outperform the market through research and analysis.

- Value Investing: Focuses on investing in undervalued assets with the expectation that their value will increase over time.

- Growth Investing: Seeks out companies with strong growth potential, often in emerging markets or innovative industries.

The Importance of Diversification

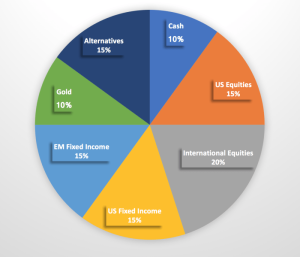

Diversification is a key element of global investment strategies as it helps reduce risk by spreading investments across different asset classes, regions, and industries. By diversifying, investors can lower the impact of negative events on their overall portfolio performance.

Impact of Geopolitical Events

- Geopolitical events, such as trade wars, political instability, or natural disasters, can have a significant impact on global investment strategies.

- These events can create market volatility, affecting asset prices and investor sentiment.

- Investors need to stay informed and adapt their strategies to mitigate risks associated with geopolitical events.

Global Economic Trends Influence

Global economic trends, such as interest rates, inflation, GDP growth, and currency fluctuations, play a crucial role in shaping investment strategies.

Understanding how these trends impact different asset classes can help investors make informed decisions and adjust their portfolios accordingly.

Investment Advice

Investment advice refers to recommendations provided by financial professionals or experts to help individuals make informed decisions about where to allocate their funds for maximum returns. This advice is crucial for individuals looking to grow their wealth and achieve their financial goals.

Examples of Common Investment Advice for Beginners:

- Start with a diversified portfolio to spread risk.

- Consider long-term investments for steady growth.

- Regularly review and adjust your investment strategy.

How to Differentiate Between Good and Bad Investment Advice:

- Good advice is based on thorough research and analysis, while bad advice may be speculative or lack evidence.

- Good advice considers your individual financial goals and risk tolerance, while bad advice may be generic and not personalized.

- Good advice comes from reputable sources, such as certified financial advisors, while bad advice may come from unreliable sources.

The Role of Risk Assessment in Providing Investment Advice:

Risk assessment plays a crucial role in investment advice as it helps determine the level of risk an individual is willing to take on and matches it with suitable investment opportunities. By understanding a client’s risk tolerance, financial advisors can tailor their advice to ensure investments align with their goals and comfort level.

Investment Advisor

An investment advisor is a professional who provides guidance and advice to clients regarding their investment decisions. These individuals are tasked with analyzing market trends, assessing risk levels, and creating personalized investment strategies to help clients achieve their financial goals.

Responsibilities of an Investment Advisor

- Conducting thorough financial assessments of clients to understand their investment objectives and risk tolerance.

- Researching and analyzing various investment opportunities to recommend the most suitable options for clients.

- Monitoring and managing client portfolios to ensure they remain aligned with their financial goals.

- Providing regular updates and reports to clients on the performance of their investments.

Qualifications Required to Become an Investment Advisor

- Obtaining relevant licenses and certifications, such as the Series 7 and Series 65, to legally provide investment advice.

- Having a strong background in finance, economics, or a related field to demonstrate expertise in investment strategies.

- Possessing excellent communication and interpersonal skills to build trust and rapport with clients.

- Continuously updating knowledge and skills through ongoing education and professional development.

Tailoring Strategies to Individual Clients

- Assessing each client’s unique financial situation, goals, and risk tolerance to create personalized investment plans.

- Considering factors such as age, income level, and long-term objectives when designing investment strategies.

- Adjusting portfolios periodically based on changing market conditions and client preferences.

Importance of Transparency and Trust

- Building a transparent relationship with clients by clearly explaining investment strategies, fees, and potential risks involved.

- Maintaining open communication channels to address any concerns or questions clients may have about their investments.

- Fostering trust through honesty, integrity, and a commitment to acting in the best interests of clients.

Investment Banking

Investment banking plays a crucial role in the global financial markets, acting as a bridge between companies and investors. These institutions provide a wide range of financial services to help clients raise capital, manage risks, and facilitate mergers and acquisitions.

Services Offered by Investment Banks

Investment banks offer services such as underwriting securities, providing financial advisory, conducting research, and facilitating trading. They also assist clients in issuing stocks and bonds, structuring deals, and managing complex financial transactions.

Investment Banking vs. Traditional Commercial Banking

Unlike traditional commercial banks that focus on deposits and loans, investment banks primarily deal with corporate clients and sophisticated investors. They do not typically engage in retail banking activities like savings accounts or mortgages. Investment banks are more involved in capital markets and provide specialized financial services.

Examples of Successful Investment Banking Strategies

- Goldman Sachs successfully advised on the acquisition of a major tech company, leading to a significant increase in market share for the acquiring firm.

- J.P. Morgan structured a complex bond issuance for a multinational corporation, raising funds at favorable interest rates and terms.

- Morgan Stanley helped a startup company go public through an initial public offering (IPO), resulting in a successful market debut and increased visibility for the company.

Investment Horizon

An investment horizon refers to the length of time an investor plans to hold an investment before selling it. It is a crucial factor in making investment decisions as it impacts the level of risk an investor is willing to take and the potential returns they expect to achieve.

Varying Investment Horizons based on Financial Goals

Different financial goals require different investment horizons. For example, a young investor saving for retirement may have a long-term investment horizon of several decades, allowing them to take on more risk in pursuit of higher returns. On the other hand, someone saving for a short-term goal like buying a house may have a shorter investment horizon and prioritize capital preservation over growth.

Aligning Investment Horizons with Risk Tolerance

It is essential to align your investment horizon with your risk tolerance. A longer investment horizon typically allows for a higher tolerance for market fluctuations and volatility, as there is more time to recover from any potential losses. On the contrary, a shorter investment horizon may require a more conservative approach to avoid significant losses close to the goal deadline.

Adjusting Investment Horizons based on Market Conditions

Market conditions can impact investment horizons. During periods of market volatility or economic uncertainty, investors may consider adjusting their investment horizons to minimize risk exposure. For example, extending the investment horizon during a market downturn can give investments more time to recover and potentially benefit from long-term growth.

Investment Opportunities

Investment opportunities in global markets are diverse and can range from traditional stocks and bonds to alternative investments like real estate and commodities. When evaluating investment opportunities, it is essential to consider factors such as risk tolerance, investment horizon, market conditions, and potential returns. Here, we will explore different types of investment opportunities, share examples of emerging opportunities in various sectors, and analyze the associated risks.

Types of Investment Opportunities

- Stocks: Investing in publicly traded companies through shares of stock.

- Bonds: Investing in fixed-income securities issued by governments or corporations.

- Real Estate: Investing in properties for rental income or capital appreciation.

- Commodities: Investing in physical goods like gold, silver, oil, or agricultural products.

Emerging Investment Opportunities

- Renewable Energy: With the push for sustainability, investments in renewable energy sources like solar and wind power are on the rise.

- Technology: Emerging technologies such as artificial intelligence, blockchain, and cybersecurity present new investment opportunities.

- Healthcare: Investments in healthcare companies focused on telemedicine, biotechnology, and pharmaceuticals are gaining traction.

Risks Associated with Investment Opportunities

- Market Risk: Fluctuations in the market can impact the value of investments.

- Interest Rate Risk: Changes in interest rates can affect bond prices.

- Business Risk: Company-specific factors can influence stock performance.

- Liquidity Risk: Some investments may be difficult to sell quickly without impacting their value.

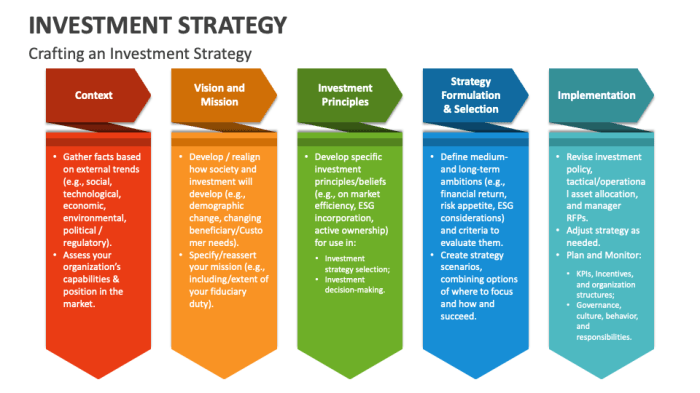

Investment Strategy

Investment strategy refers to a plan or method used by an investor to allocate capital in various financial instruments with the goal of achieving specific financial objectives. It is crucial for individuals to have a well-defined investment strategy to navigate the complex world of investing and maximize returns while managing risks effectively.

Key Components of a Successful Investment Strategy

- Asset Allocation: Determining the mix of assets (stocks, bonds, cash, real estate, etc.) in your portfolio based on your risk tolerance, investment horizon, and financial goals.

- Diversification: Spreading investments across different asset classes, industries, and geographic regions to reduce risk and enhance returns.

- Risk Management: Implementing strategies to mitigate potential losses through tools like stop-loss orders, hedging, and proper asset allocation.

- Regular Monitoring and Rebalancing: Reviewing your portfolio periodically to ensure it aligns with your investment goals and making adjustments as needed.

Tips for Developing a Personalized Investment Strategy

- Set Clear Financial Goals: Define your investment objectives, whether it’s saving for retirement, buying a home, or funding your children’s education.

- Assess Risk Tolerance: Understand how much risk you are willing to take on and ensure your investment strategy aligns with your risk profile.

- Seek Professional Advice: Consult with a financial advisor to help you create a customized investment plan tailored to your needs and goals.

- Stay Informed: Keep yourself updated on market trends, economic indicators, and geopolitical events that may impact your investment decisions.

Market Research’s Role in Shaping Investment Strategies

Market research plays a crucial role in shaping investment strategies by providing valuable insights into market trends, competitor analysis, consumer behavior, and economic forecasts. By conducting thorough market research, investors can make informed decisions, identify potential opportunities, and mitigate risks associated with their investment portfolios.

In conclusion, Global Investment Strategies offer a roadmap to financial success by navigating through diversified portfolios and staying informed about market dynamics.

Commonly Asked Questions

What are the benefits of diversification in global investment strategies?

Diversification helps reduce risk by spreading investments across different assets and regions, safeguarding against market volatility.

How do geopolitical events impact global investment strategies?

Geopolitical events can lead to market fluctuations, affecting investment decisions and highlighting the importance of staying informed.

What role does risk assessment play in providing investment advice?

Risk assessment helps advisors tailor investment recommendations to match clients’ risk tolerance levels and financial goals.