Embark on a journey into the world of Global Diversification Investment Strategy, where opportunities abound and risks are mitigated. Explore the key aspects of this strategy and unlock the potential for your investment portfolio.

What is Global Diversification Investment Strategy?

Global diversification in investment refers to spreading your investment across different countries, regions, industries, and asset classes to reduce risk and increase potential returns. By investing in a variety of markets, you can minimize the impact of a downturn in any single market on your overall portfolio.

Benefits of a Global Diversification Strategy

- Diversification lowers overall portfolio risk: By investing in different markets, you reduce the impact of market-specific risks on your portfolio.

- Potential for higher returns: Global diversification allows you to access opportunities in different regions and industries that may outperform others.

- Hedging against currency risk: Investing in multiple currencies can help protect your portfolio from fluctuations in any single currency.

Examples of How Global Diversification Can Reduce Risk

- During the 2008 financial crisis, investors with a globally diversified portfolio were less affected by the downturn in the U.S. market as they had exposure to other regions that were performing better.

- Political instability in one country may negatively impact investments, but having exposure to stable economies through global diversification can help mitigate this risk.

- Industry-specific events, such as the decline of the oil industry, can be offset by investments in other sectors within a globally diversified portfolio.

Factors to Consider in Global Diversification Investment Strategy

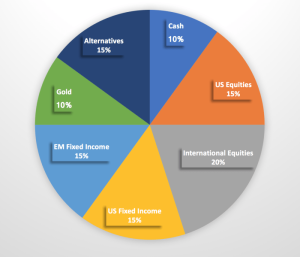

Global diversification is a key strategy for investors looking to spread risk and maximize returns. When implementing a global diversification investment strategy, there are several important factors to consider to ensure a well-balanced and effective portfolio.Asset Allocation in a Global Diversification Strategy:Asset allocation is crucial in a global diversification strategy as it involves spreading investments across different asset classes such as stocks, bonds, real estate, and commodities.

By diversifying investments across various asset classes, investors can reduce the overall risk in their portfolio. This helps to mitigate the impact of market fluctuations and economic downturns, ensuring a more stable and potentially higher return on investment.Including Different Regions or Industries for Diversification:Diversifying across different regions or industries is essential in a global diversification strategy. By investing in companies from various regions around the world, investors can benefit from economic growth in different markets and reduce the risk associated with being too heavily concentrated in one area.

Similarly, investing across different industries helps to spread risk and capitalize on opportunities in sectors that may be experiencing growth while others are struggling.Impact of Currency Exchange Rates on Global Investments:Currency exchange rates play a significant role in global investments as they can impact the value of investments denominated in foreign currencies. Fluctuations in exchange rates can either boost or erode returns for investors holding assets in different currencies.

It’s important for investors to consider the potential impact of currency movements on their portfolio and implement strategies to mitigate currency risk, such as hedging or diversifying currency exposure.

Conclusion

In conclusion, asset allocation, diversification across regions and industries, and managing currency risk are critical factors to consider in a global diversification investment strategy. By carefully balancing these factors, investors can build a well-diversified portfolio that is better positioned to weather market volatility and achieve long-term financial goals.

Investment Opportunities in Global Diversification

Global diversification offers investors the chance to explore emerging markets that have significant growth potential. These markets may provide opportunities for higher returns compared to more established economies. Additionally, technology and innovation play a crucial role in shaping global investment opportunities, as advancements in these areas can disrupt industries and create new investment avenues. Geopolitical factors also play a key role in influencing investment decisions in a global context, as political stability, trade agreements, and regional conflicts can impact the performance of investments.

Identifying Emerging Markets

Emerging markets such as China, India, Brazil, and South Africa offer investors the potential for high growth due to factors like expanding consumer markets, increasing urbanization, and favorable demographics. These markets often have lower valuations compared to developed economies, presenting attractive investment opportunities for those willing to take on higher risk for potentially higher returns.

Role of Technology and Innovation

Technological advancements and innovations have the power to transform industries and create new investment opportunities globally. Sectors such as artificial intelligence, renewable energy, and e-commerce are areas where technological disruption is driving growth and shaping the future of investment opportunities. Investors who stay informed about these trends can capitalize on the potential returns offered by these sectors.

Geopolitical Factors in Investment Decisions

Geopolitical factors such as trade tensions, regulatory changes, and global conflicts can significantly impact investment decisions in a global context. Investors need to consider the political stability of countries, trade agreements, and regional alliances when making investment choices. By staying informed about geopolitical developments, investors can better navigate risks and identify opportunities in the global market.

Investment Advice and Strategies

When it comes to global diversification, selecting the right investment advisor is crucial for maximizing returns and managing risk effectively. A qualified advisor can help you navigate the complexities of international markets and tailor your investment strategy to your financial goals and risk tolerance.

Selecting an Investment Advisor for Global Diversification

- Look for advisors with experience in global markets and a track record of successful international investments.

- Consider advisors who have certifications or credentials in international finance or investment management.

- Choose an advisor who takes the time to understand your individual financial situation, goals, and risk tolerance.

- Seek recommendations from trusted sources or do thorough research on potential advisors before making a decision.

Common Investment Strategies in Global Diversification

- Dollar-cost averaging: Investing a fixed amount regularly regardless of market conditions to reduce the impact of market volatility.

- Asset allocation: Diversifying investments across different asset classes such as stocks, bonds, and real estate to manage risk.

- Value investing: Identifying undervalued assets in global markets with the potential for long-term growth.

- Market timing: Attempting to buy and sell investments based on predicting market movements, which can be risky and difficult to execute successfully.

Aligning Investment Strategies with Long-term Financial Goals

- Define clear and realistic financial goals to guide your investment decisions and risk tolerance.

- Regularly review and adjust your investment portfolio based on changes in your financial situation, market conditions, and long-term goals.

- Consider working with your investment advisor to create a customized investment plan that aligns with your objectives and time horizon.

- Stay disciplined and avoid emotional decision-making by focusing on your long-term financial goals rather than short-term market fluctuations.

In conclusion, Global Diversification Investment Strategy offers a robust approach to growing your investments while safeguarding against market fluctuations. By diversifying globally, investors can tap into new markets and secure long-term financial success.

FAQ Explained

What is the primary goal of Global Diversification Investment Strategy?

The main aim is to spread investments across various regions and industries to minimize risk and maximize returns.

How does currency exchange rates impact global investments?

Changes in currency exchange rates can affect the value of international investments, either positively or negatively.

What role does technology play in global investment opportunities?

Technology often drives innovation and growth in various sectors, presenting lucrative investment prospects globally.