Diving into the realm of Emerging Markets Investment Strategy, this introduction sets the stage for a comprehensive exploration of the topic, shedding light on the potential rewards and pitfalls that investors may encounter in these dynamic markets.

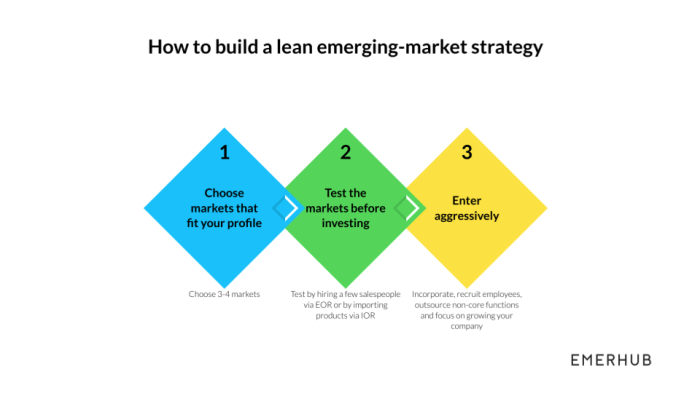

Exploring the intricacies of crafting a robust investment strategy tailored for emerging markets, this overview aims to equip readers with the essential knowledge and insights needed to navigate this complex landscape effectively.

Introduction to Emerging Markets Investment Strategy

Emerging markets refer to countries that are experiencing rapid economic growth and industrialization. These markets are characterized by lower income levels, high growth potential, and evolving financial systems.

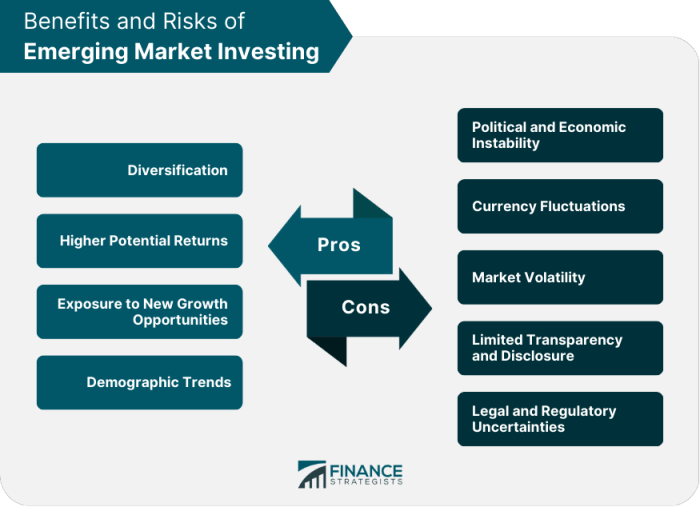

Investing in emerging markets can offer potential benefits such as high returns on investment, diversification opportunities, and exposure to new growth opportunities. However, it also comes with risks such as political instability, currency fluctuations, and regulatory challenges.

Importance of a Well-Defined Investment Strategy

Having a well-defined investment strategy is crucial when considering emerging markets. It helps investors navigate the unique challenges and opportunities present in these markets, manage risks effectively, and achieve their investment objectives.

Factors to Consider in Developing an Emerging Markets Investment Strategy

When developing an investment strategy for emerging markets, there are several key factors that need to be taken into consideration to ensure success. Factors such as economic growth, political stability, currency risk, and regulatory environment play a crucial role in shaping investment decisions in these markets. Additionally, cultural differences and social factors can also impact investment choices, making it essential for investors to have a deep understanding of local market conditions and dynamics.

Economic Growth

Economic growth is a fundamental factor to consider when investing in emerging markets. Countries experiencing robust economic growth typically present attractive investment opportunities, as they offer the potential for high returns. Investors should analyze factors such as GDP growth, inflation rates, and employment trends to gauge the economic health of a particular market.

Political Stability

Political stability is another vital consideration for investors in emerging markets. Political unrest, corruption, and frequent changes in government can create uncertainty and adversely impact investments. It is crucial to assess the political landscape of a country before making investment decisions to mitigate risks associated with instability.

Currency Risk

Currency risk is inherent in emerging markets due to fluctuations in exchange rates. Investors need to evaluate the stability of a country’s currency and its impact on investment returns. Hedging strategies can be employed to manage currency risk and protect investment portfolios from adverse movements in exchange rates.

Regulatory Environment

The regulatory environment of a country plays a significant role in shaping investment opportunities. Investors must understand the legal framework governing investments in emerging markets, including tax policies, foreign ownership restrictions, and regulatory compliance requirements. Adherence to local regulations is essential to avoid legal complications and protect investments.

Cultural Differences and Social Factors

Cultural differences and social factors can influence investment decisions in emerging markets. Understanding the local customs, traditions, and societal norms is crucial for building relationships and navigating business interactions successfully. Investors who respect and adapt to cultural differences are more likely to establish trust and credibility within the market.

Local Market Conditions and Dynamics

Having a thorough understanding of local market conditions and dynamics is essential for formulating a successful investment strategy in emerging markets. Factors such as consumer behavior, competitive landscape, and technological advancements can impact the performance of investments. Conducting market research and staying informed about industry trends are key to making informed decisions.

Investment Opportunities in Emerging Markets

Emerging markets offer a plethora of investment opportunities across various sectors and industries. These markets are characterized by rapid economic growth, expanding consumer bases, and evolving business landscapes, making them attractive for investors seeking high returns.

Technology Sector

The technology sector in emerging markets presents significant investment potential due to the increasing adoption of digital solutions and the rise of tech-savvy consumers. Companies specializing in e-commerce, fintech, and software development are thriving in these markets, offering promising investment prospects.

Renewable Energy Industry

The renewable energy industry in emerging markets is experiencing substantial growth as governments and businesses prioritize sustainability. Investments in solar, wind, and hydroelectric power projects have shown remarkable returns, tapping into the rising demand for clean energy solutions.

Healthcare and Pharmaceuticals

The healthcare and pharmaceutical sectors in emerging markets are expanding rapidly to meet the healthcare needs of growing populations. Investments in hospitals, medical technology, and pharmaceutical companies have proven to be lucrative, driven by increasing healthcare spending and advancements in medical research.

Examples of Successful Investments

- Investing in a leading e-commerce platform in Southeast Asia that has seen exponential growth in user base and revenue.

- Funding a renewable energy startup in Africa that has successfully implemented solar energy projects across remote communities.

- Backing a pharmaceutical company in Latin America that has developed breakthrough treatments for prevalent diseases in the region.

Technological Advancements and Investment Opportunities

Technological advancements, such as artificial intelligence, blockchain, and Internet of Things (IoT), are revolutionizing industries in emerging markets. These innovations are creating new investment opportunities in sectors like agriculture, logistics, and finance, enabling investors to capitalize on the digital transformation wave sweeping through these markets.

Investment Strategies for Risk Management in Emerging Markets

Investing in emerging markets can offer lucrative opportunities but comes with inherent risks. Implementing effective risk management strategies is crucial to navigate these challenges and maximize returns.

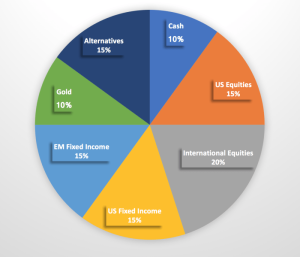

Diversification Strategies

One key strategy to mitigate risks in emerging markets is diversification. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce the impact of any single negative event on their portfolio. This helps to balance out potential losses and increase the overall stability of the investment.

Role of Currency Hedging

Currency fluctuations can significantly impact the returns of investments in emerging markets. To manage this risk, investors can use currency hedging techniques. By entering into financial contracts that offset the risk of currency fluctuations, investors can protect their returns from being eroded by adverse movements in exchange rates.

Impact Investing in Emerging Markets

Impact investing involves making investments with the intention of generating positive social or environmental impact alongside financial returns. In emerging markets, impact investing can play a crucial role in supporting sustainable development and addressing social challenges. By targeting investments in sectors such as renewable energy, healthcare, or education, investors can contribute to positive change while also diversifying their portfolios and managing risks.

Investment Horizon and Long-term Growth in Emerging Markets

Investing in emerging markets requires a long-term perspective to fully capture the growth potential and maximize returns. While short-term fluctuations and volatility may occur, a patient approach can result in significant gains over an extended investment horizon.

Successful Long-Term Investment Strategies in Emerging Markets

- Diversification: Spread investments across different emerging markets to reduce risk and capitalize on growth opportunities in various regions.

- Focus on Fundamental Analysis: Conduct thorough research on the economic and political landscape of each market to make informed investment decisions.

- Regular Monitoring and Rebalancing: Stay updated on market developments and adjust your portfolio accordingly to maintain alignment with your long-term goals.

Investment Advisor’s Role in Crafting an Emerging Markets Investment Strategy

Seeking advice from investment advisors with expertise in emerging markets is invaluable for investors looking to navigate the complexities and opportunities in these dynamic regions. Investment advisors can provide personalized guidance tailored to individual risk tolerance and financial goals, helping investors make informed decisions that align with their specific needs and objectives.

Tailoring an Investment Strategy Based on Individual Risk Tolerance and Financial Goals

Investment advisors play a crucial role in assessing an investor’s risk tolerance and financial goals to develop a customized investment strategy for emerging markets. By understanding the client’s preferences, time horizon, and financial situation, advisors can recommend suitable investment options that balance risk and return potential. This personalized approach ensures that the investment strategy is aligned with the client’s objectives, helping them achieve their financial goals while managing risk effectively.

Navigating Regulatory Complexities in Emerging Markets

Emerging markets often present regulatory challenges and legal complexities that can impact investment decisions. Investment advisors with expertise in these regions can provide valuable insights and guidance on navigating regulatory requirements, compliance issues, and market-specific nuances. By staying informed about the regulatory landscape and market dynamics, advisors can help investors navigate potential pitfalls and capitalize on opportunities in emerging markets effectively.

Investment Banking Services for Emerging Markets

Investment banks play a crucial role in facilitating investments in emerging markets by providing a range of services to clients looking to capitalize on opportunities in these dynamic economies.

Risk Assessment and Management

Investment banks assess and manage risks associated with investments in emerging markets through thorough due diligence processes. They conduct in-depth analyses of political, economic, and regulatory factors that could impact investments. By leveraging their expertise and access to valuable market data, investment banks help clients make informed decisions to mitigate risks effectively.

Services and Products Offered

Investment banks offer a wide array of services and products to clients interested in emerging markets, including:

- Underwriting: Investment banks help companies raise capital by underwriting securities offerings, such as initial public offerings (IPOs) or bond issuances.

- Merger and Acquisition (M&A) Advisory: Investment banks provide strategic advice to clients on M&A transactions in emerging markets, helping them navigate complex deal structures and negotiations.

- Debt and Equity Financing: Investment banks assist clients in raising debt or equity financing for their projects in emerging markets, optimizing capital structures and funding sources.

- Financial Advisory: Investment banks offer financial advisory services, such as valuation, restructuring, and capital allocation guidance, to clients seeking to maximize returns on their investments.

- Risk Management Solutions: Investment banks develop customized risk management solutions for clients to hedge against currency, interest rate, or commodity price fluctuations in emerging markets.

Investment banks play a pivotal role in providing comprehensive support to investors seeking to navigate the complexities of emerging markets and capitalize on lucrative opportunities for growth and diversification.

In conclusion, the discussion on Emerging Markets Investment Strategy underscores the critical importance of strategic planning, risk management, and long-term vision in capitalizing on the vast opportunities presented by these burgeoning markets. By understanding the nuances of investing in emerging economies, individuals and institutions can position themselves for sustainable growth and success in an ever-evolving global financial landscape.

FAQ Insights

What are some common misconceptions about investing in emerging markets?

Investing in emerging markets is often perceived as high-risk, but with proper research and a well-defined strategy, it can also offer high rewards.

How can investors mitigate currency risks when investing in emerging markets?

One way to hedge against currency risks is through diversification of investments across different currencies or using financial instruments like forward contracts.

Are there specific sectors within emerging markets that are particularly attractive for investment?

Technology, healthcare, and consumer goods sectors are examples of industries that often present promising investment opportunities in emerging markets.

What role do geopolitical factors play in shaping investment strategies for emerging markets?

Geopolitical stability, trade policies, and regional conflicts can significantly impact investment decisions and risk assessments in emerging markets.