Embark on a journey into the realm of Asset Allocation Strategy for Investors, where the art of diversification leads to optimized returns and minimized risks. This insightful exploration delves into the intricacies of investment portfolios with a focus on maximizing potential gains.

Unveil the secrets behind constructing a well-diversified portfolio and discover how investors can navigate the complex world of asset allocation with confidence and precision.

Asset Allocation Strategy for Investors

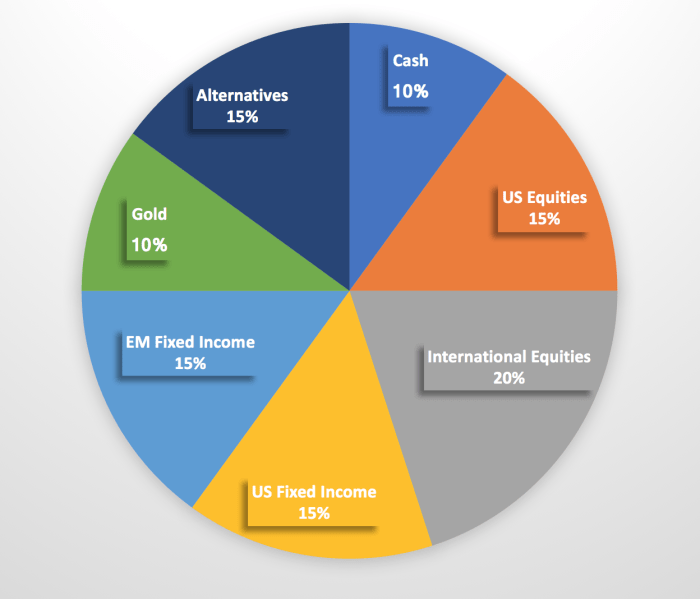

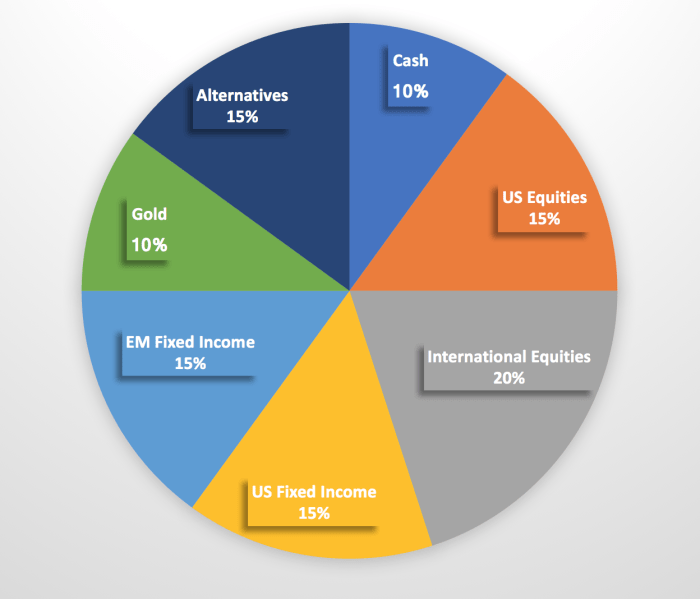

Asset allocation is the process of dividing an investment portfolio among different asset classes such as stocks, bonds, real estate, and cash equivalents. It is a crucial component of investment strategy as it helps investors manage risk and optimize returns.

Examples of Asset Classes

- Stocks: Ownership in a company that represents a share of the company’s assets and earnings.

- Bonds: Debt securities issued by governments or corporations that pay a fixed interest rate over a specified period.

- Real Estate: Physical properties such as residential, commercial, or industrial properties.

- Cash Equivalents: Low-risk, highly liquid assets such as treasury bills, certificates of deposit, or money market funds.

Benefits of Diversification

Diversification across different asset classes can help reduce overall portfolio risk by spreading investments across various sectors and industries. It also provides the opportunity to capture returns from different sources, potentially leading to higher overall returns.

Determining Risk Tolerance and Time Horizon

- Assess your risk tolerance by considering how comfortable you are with market fluctuations and potential losses.

- Identify your investment time horizon, whether short-term or long-term, to align your asset allocation with your financial goals.

- Consult with a financial advisor to help you determine the optimal asset allocation based on your risk tolerance and time horizon.

Investment Advice

When it comes to managing investments, seeking advice from professional investment advisors can play a crucial role in helping clients develop personalized investment strategies that align with their financial goals and risk tolerance.

Role of Investment Advisors

Investment advisors are skilled professionals who provide guidance and recommendations to clients on how to effectively manage their investment portfolios. They analyze market trends, assess risk factors, and create customized strategies tailored to individual needs.

Importance of Professional Advice

It is essential to seek professional advice when making investment decisions as advisors possess the expertise and knowledge needed to navigate the complexities of the financial markets. Their insights can help clients make informed choices and avoid common pitfalls.

Types of Investment Advice

- Asset Allocation: Advisors help clients diversify their investments across different asset classes to manage risk and maximize returns.

- Portfolio Rebalancing: They assist in adjusting the portfolio mix to maintain the desired risk level and meet changing financial objectives.

- Financial Planning: Advisors offer comprehensive financial planning services to help clients achieve their long-term goals, such as retirement or education funding.

Choosing a Reputable Advisor

When selecting an investment advisor, individuals should consider factors such as qualifications, experience, track record, and communication style. It is advisable to conduct thorough research, ask for referrals, and interview potential advisors to ensure a good fit for their financial needs.

Investment Banking

Investment banks play a crucial role in the financial market by providing a range of services to corporations and governments. These services include facilitating mergers and acquisitions, underwriting securities, and assisting in raising capital through debt and equity offerings.

Role of Investment Banks

Investment banks differ from traditional banks in that they focus on providing financial services to large corporations, institutional investors, and governments rather than individual clients. They help companies navigate complex financial transactions and capital markets to achieve their strategic objectives.

- Facilitating Mergers and Acquisitions (M&A): Investment banks assist companies in mergers, acquisitions, and divestitures by providing advisory services, conducting valuations, and negotiating deals to maximize shareholder value.

- Underwriting Securities: Investment banks underwrite securities such as stocks and bonds, helping companies raise capital by issuing new shares or debt instruments to investors.

Capital Raising Services

Investment banks play a crucial role in helping companies raise capital through debt and equity offerings. They assist in structuring the offering, pricing the securities, and marketing them to investors to ensure a successful capital raise.

- Debt Offerings: Investment banks help companies issue bonds or other debt instruments to raise funds for various purposes, such as refinancing existing debt, funding growth initiatives, or financing acquisitions.

- Equity Offerings: Investment banks assist companies in issuing new shares of stock through initial public offerings (IPOs) or follow-on offerings to raise equity capital from investors.

Examples of Investment Banking Transactions

Investment banks are involved in various types of transactions, including mergers and acquisitions (M&A) and underwriting of securities. These transactions play a crucial role in driving economic growth and corporate development.

- Mergers and Acquisitions (M&A): Investment banks advise companies on potential mergers, acquisitions, or divestitures, helping them evaluate strategic opportunities, conduct due diligence, and negotiate deal terms.

- Underwriting: Investment banks underwrite securities offerings, such as IPOs, bond issuances, and syndicated loans, by guaranteeing the sale of the securities to investors and assuming the risk of any unsold shares.

Investment Horizon

Investment horizon refers to the length of time an investor expects to hold an investment before selling it. It plays a crucial role in determining the appropriate asset allocation strategy and investment products for achieving financial goals.

Impact of Investment Horizon on Product Selection

The investment horizon directly influences the selection of investment products as it determines the level of risk an investor can afford to take. Short-term investors may opt for more liquid and low-risk investments, while long-term investors can consider higher-risk investments with potential for higher returns.

- Short-term Horizon: Investors with a short-term horizon, typically less than a year, may focus on preserving capital and liquidity. Suitable investment products include savings accounts, certificates of deposit (CDs), and short-term bonds.

- Medium-term Horizon: Investors with a medium-term horizon, usually one to five years, may seek a balance between risk and return. Investment products such as balanced mutual funds, corporate bonds, and real estate investment trusts (REITs) can be considered.

- Long-term Horizon: Investors with a long-term horizon, usually more than five years, can afford to take higher risks for potentially higher returns. Suitable investment products include equity mutual funds, individual stocks, and exchange-traded funds (ETFs).

Aligning Investment Horizon with Financial Goals

To align their investment horizon with financial goals, investors should:

- Clearly define their financial goals and time horizon for achieving them.

- Select investment products that match their investment horizon and risk tolerance.

- Regularly review and adjust their investment portfolio to ensure alignment with changing financial goals and time horizon.

Investment Opportunities

In today’s dynamic financial landscape, investors have a plethora of investment opportunities across different asset classes to consider. It is essential for investors to carefully evaluate these opportunities based on various factors to make informed decisions.

Stocks

- Stocks offer investors the opportunity to own a portion of a company and benefit from its growth and profitability.

- Factors to consider when evaluating stocks include the company’s financial health, industry trends, and overall market conditions.

- Investors can identify high-potential stocks by conducting thorough research on the company’s performance, management team, and growth prospects.

Bonds

- Bonds provide a fixed income stream to investors through interest payments.

- Investors should consider factors such as the bond issuer’s credit rating, maturity date, and prevailing interest rates when evaluating bond opportunities.

- High-potential bond opportunities may exist in emerging markets or sectors with strong growth potential.

Mutual Funds

- Mutual funds pool investors’ money to invest in a diversified portfolio of securities.

- When considering mutual fund opportunities, investors should assess factors such as the fund’s investment strategy, performance history, and fees.

- Investors can identify promising mutual funds by analyzing their investment objectives, holdings, and past returns.

Real Estate

- Real estate investments offer investors the opportunity to generate rental income and benefit from property appreciation.

- Factors to consider when evaluating real estate opportunities include location, market trends, and potential for rental yield or capital appreciation.

- Investors can explore high-potential real estate opportunities in emerging markets or in growing industries such as technology hubs or urban redevelopment projects.

Commodities

- Investing in commodities such as gold, oil, or agricultural products can provide diversification and a hedge against inflation.

- Factors to consider when evaluating commodity investments include supply and demand dynamics, geopolitical factors, and global economic trends.

- Investors can identify attractive commodity opportunities by monitoring price trends, geopolitical developments, and global market conditions.

Investment Strategy

Having a well-defined investment strategy is crucial for achieving financial goals as it provides a roadmap to guide investors towards their objectives. A carefully crafted investment strategy takes into account factors such as risk tolerance, time horizon, and financial goals, helping investors make informed decisions and stay focused on their long-term objectives.

Types of Investment Strategies

- Growth Strategy: Focuses on investing in companies with high growth potential, aiming for capital appreciation.

- Value Strategy: Seeks to invest in undervalued assets with the potential to increase in value over time.

- Income Strategy: Prioritizes investments that generate regular income, such as dividend-paying stocks or bonds.

Each type of investment strategy has its own set of characteristics and is suitable for different types of investors depending on their risk tolerance and financial goals.

Developing a Personalized Investment Strategy

- Assess Risk Tolerance: Understand how much risk you are willing to take on and align your investments accordingly.

- Set Clear Objectives: Define your financial goals, whether it’s saving for retirement, buying a house, or funding education.

- Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk and maximize returns.

By tailoring an investment strategy to their individual needs and circumstances, investors can build a portfolio that aligns with their objectives and risk profile.

Common Investment Mistakes to Avoid

- Market Timing: Trying to predict market movements can lead to missed opportunities and increased risk.

- Lack of Diversification: Concentrating investments in a few assets can expose investors to unnecessary risk.

- Ignoring Long-Term Goals: Focusing on short-term gains without considering long-term objectives can hinder financial growth.

Avoiding these common pitfalls can help investors stay on track with their investment strategy and achieve their financial goals effectively.

In conclusion, the path to financial success lies in the strategic deployment of asset allocation tactics. By embracing a diversified approach, investors can fortify their portfolios and unlock a world of investment possibilities.

FAQ Guide

How can asset allocation benefit investors?

Asset allocation can help investors minimize risks and maximize returns by spreading investments across different asset classes.

What factors should investors consider when determining their risk tolerance?

Investors should assess their financial goals, time horizon, and comfort level with market fluctuations to gauge their risk tolerance effectively.

Why is it essential to seek professional advice for investment decisions?

Professional advice can provide valuable insights, expertise, and personalized strategies tailored to individual financial objectives and risk profiles.

How can investors align their investment horizon with their financial goals?

Investors can align their investment horizon by setting clear objectives, understanding their risk appetite, and choosing suitable investment products accordingly.

What are some common investment mistakes that investors should avoid?

Investors should steer clear of emotional decision-making, neglecting diversification, and failing to adapt their strategies to changing market conditions.