Delving into Crowdfunding Investment Opportunities, this introduction immerses readers in a unique and compelling narrative. Crowdfunding has revolutionized the investment landscape, providing individuals with exciting avenues to participate in funding projects and businesses. As we navigate through the realm of crowdfunding, we uncover the advantages, risks, and diverse investment opportunities that await curious investors.

From understanding the core concepts of crowdfunding to exploring the role of investment advisors and the intricacies of investment strategies, this comprehensive guide equips readers with the knowledge needed to embark on their crowdfunding investment journey with confidence. Let’s unravel the mysteries and unveil the potential of Crowdfunding Investment Opportunities together.

Crowdfunding Investment Opportunities

Crowdfunding in the investment context refers to the practice of funding a project or venture by raising small amounts of money from a large number of people, typically via online platforms. Investors, both individuals, and institutions, contribute funds to a project in exchange for equity, debt, or rewards.

Advantages and Disadvantages of Crowdfunding Investment Opportunities

Crowdfunding investment opportunities offer several advantages, such as:

- Access to a wider pool of potential investors

- Lower barriers to entry for both investors and entrepreneurs

- Potential for higher returns compared to traditional investments

However, there are also disadvantages to consider, including:

- High levels of competition for funding

- Lack of investor protection regulations

- Potential for fraud and failed projects

Types of Projects Funded through Crowdfunding Platforms

Crowdfunding platforms are commonly used to fund projects in various industries, including:

- Tech startups

- Real estate developments

- Artistic ventures

- Social causes and charitable initiatives

Risks Associated with Investing in Crowdfunding Opportunities

Investing in crowdfunding opportunities comes with risks that investors should consider, such as:

- Lack of liquidity for investments

- Potential for project failure and loss of invested capital

- Difficulty in assessing the viability and credibility of projects

Investment Advice

When considering crowdfunding opportunities, it is essential to keep in mind some key investment advice to make informed decisions and maximize your potential returns.

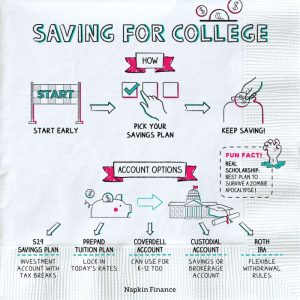

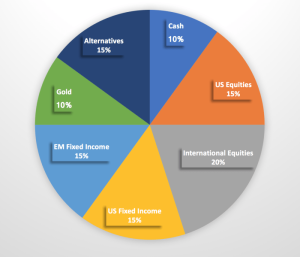

The Importance of Diversification

Diversification is crucial when exploring crowdfunding investments. By spreading your investment across different projects or industries, you can reduce risk and increase the chances of overall portfolio growth.

Due Diligence in Investment Decisions

Due diligence plays a critical role in making informed investment decisions. It involves thoroughly researching and analyzing the crowdfunding project, including the team behind it, market potential, and financial projections.

Evaluating Credibility and Potential

When evaluating crowdfunding projects, consider factors such as the project’s business model, market demand, competition analysis, and the track record of the project creators. Look for transparency, a clear roadmap, and realistic goals.

Investment Advisor

An investment advisor plays a crucial role in guiding clients towards making informed decisions when it comes to crowdfunding investments. They provide valuable insights, analysis, and recommendations to help investors navigate the complex world of crowdfunding.

Qualifications and Expertise

To become a successful investment advisor in the crowdfunding space, one needs to have a strong background in finance, economics, or a related field. Obtaining relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) can also enhance credibility. Additionally, staying updated on market trends, regulations, and emerging crowdfunding platforms is essential to provide the best advice to clients.

Ethical Considerations

Investment advisors need to adhere to strict ethical guidelines when recommending crowdfunding opportunities to clients. They should always prioritize the best interests of their clients, disclose any conflicts of interest, and ensure transparency in their dealings. Upholding integrity, honesty, and professionalism is paramount in maintaining trust with clients.

Adding Value to Investors

Investment advisors can add value to crowdfunding investors by conducting thorough due diligence on investment opportunities, assessing risk profiles, and creating diversified portfolios tailored to individual goals and preferences. They can also provide ongoing monitoring, performance evaluations, and strategic adjustments to optimize returns and minimize risks for clients.

Investment Banking

Investment banking plays a crucial role in the financial markets, connecting businesses in need of capital with investors looking to grow their wealth. When it comes to raising capital, traditional investment banking and crowdfunding offer distinct approaches.

Traditional vs. Crowdfunding for Capital Raising

- Traditional investment banking involves large financial institutions helping corporations raise capital through methods like IPOs, bond issuances, and private placements.

- Crowdfunding, on the other hand, allows businesses to raise smaller amounts of capital from a larger pool of individual investors through online platforms.

- While traditional investment banking targets institutional investors, crowdfunding opens up opportunities for retail investors to participate in funding projects.

Investment Banks in Crowdfunding

- Investment banks can play a crucial role in facilitating crowdfunding campaigns for businesses by providing expertise in structuring deals, conducting due diligence, and connecting companies with investors.

- They help businesses navigate the regulatory landscape, assess market conditions, and optimize their fundraising strategies to attract potential investors.

Assessing Viability of Crowdfunding Projects

- Investment banks evaluate the viability of crowdfunding projects by analyzing the business model, market potential, financial projections, and management team of the company seeking funding.

- They assess the risks and rewards associated with the project, conduct thorough research, and provide recommendations to investors based on their findings.

Successful Collaborations

- One notable example of successful collaboration between investment banks and crowdfunding platforms is the partnership between Goldman Sachs and a leading crowdfunding platform to provide access to capital for small and medium-sized enterprises.

- Another example is a collaboration between JP Morgan and a crowdfunding platform to support innovative startups in raising funds from a wider pool of investors.

Investment Horizon

Investment horizon refers to the time period over which an investor expects to hold an investment before selling it for a profit. It is a crucial aspect to consider when exploring crowdfunding investment opportunities as it can greatly impact the overall return on investment.

Varying Investment Horizons

The investment horizon can vary based on the type of crowdfunding project or platform. For example, equity crowdfunding projects typically have a longer investment horizon compared to reward-based crowdfunding projects. Additionally, the platform’s terms and conditions may also influence the investment horizon, with some platforms offering shorter-term investments while others require a longer commitment.

Aligning with Financial Goals

To align their investment horizon with their financial goals, investors should first clearly define their objectives, whether it be short-term gains or long-term growth. Understanding one’s risk tolerance and financial needs is essential in determining the appropriate investment horizon when evaluating crowdfunding opportunities.

Managing the Investment Horizon

Diversification

Spread investments across different crowdfunding projects with varying investment horizons to balance risk and return.

Regular Review

Periodically review and adjust the investment horizon based on changing financial goals and market conditions.

Exit Strategy

Have a clear exit strategy in place to liquidate investments when needed or to take profits at the right time.

Stay Informed

Stay updated on the performance of crowdfunding projects and the overall market to make informed decisions regarding the investment horizon.

Investment Opportunities

Crowdfunding platforms offer a variety of investment opportunities for individuals looking to diversify their portfolios and potentially earn high returns. These opportunities can range from investing in startups and real estate to peer-to-peer lending and equity crowdfunding.

Types of Crowdfunding Investment Opportunities

- Equity Crowdfunding: Investors can buy a stake in a company in exchange for equity shares, allowing them to potentially profit from the company’s growth.

- Reward-based Crowdfunding: Investors receive a reward or product in exchange for their investment, such as early access to a product or exclusive perks.

- Debt Crowdfunding: Investors lend money to individuals or businesses and receive regular interest payments until the loan is repaid.

Risk-Return Profiles

- Equity crowdfunding typically offers high returns but comes with higher risks due to the potential for startup failure.

- Debt crowdfunding offers lower returns but with lower risks, as investors receive fixed interest payments regardless of the company’s performance.

- Reward-based crowdfunding carries moderate risk, depending on the success of the project or product being funded.

Scalability and Growth Potential

Investments made through crowdfunding have the potential for significant scalability and growth, especially in innovative and high-growth sectors. By investing in early-stage startups, investors can benefit from the exponential growth of successful companies.

Regulatory Considerations

Regulatory considerations play a crucial role in shaping investment opportunities in the crowdfunding space. Different countries have varying regulations that impact the types of investments allowed, investor protection measures, and crowdfunding platform requirements.

- Investors should be aware of the regulatory framework in their jurisdiction to ensure compliance and mitigate risks associated with investing through crowdfunding platforms.

- Regulatory changes can affect the accessibility and attractiveness of certain investment opportunities, making it essential for investors to stay informed about the evolving landscape.

Investment Strategy

When it comes to crowdfunding investments, having a solid investment strategy is essential for success. It is crucial for individuals looking to diversify into crowdfunding to set clear investment goals and determine their risk tolerance levels before jumping into any investment opportunities.

Importance of Clear Investment Goals and Risk Tolerance

Setting clear investment goals helps investors stay focused and make informed decisions. It enables them to align their investments with their financial objectives, whether it be short-term gains or long-term growth. Determining risk tolerance levels is equally important as it helps investors understand how much volatility they can handle in their investment portfolio.

Successful Investment Strategies in Crowdfunding

- Investing in a diversified portfolio of crowdfunding projects across different industries to spread risk.

- Regularly reviewing and adjusting the investment portfolio based on performance and market conditions.

- Staying informed about industry trends and emerging opportunities in the crowdfunding space.

Tips for Adjusting Investment Strategies

- Monitor market conditions and adjust portfolio allocation accordingly to capitalize on growth opportunities.

- Stay updated on regulatory changes that may impact crowdfunding investments and adjust strategies accordingly.

- Consider rebalancing the portfolio periodically to ensure alignment with investment goals and risk tolerance levels.

As we conclude our exploration of Crowdfunding Investment Opportunities, it becomes evident that this innovative form of investment holds immense promise and potential for both seasoned investors and newcomers alike. By embracing the principles of diversification, due diligence, and strategic planning, individuals can navigate the world of crowdfunding with clarity and purpose. Whether you aim to support groundbreaking projects or seek lucrative returns, crowdfunding offers a gateway to a dynamic and evolving investment landscape.

Question & Answer Hub

What are the common risks associated with crowdfunding investment opportunities?

Common risks include project failure, lack of liquidity, and regulatory uncertainties that investors should consider before committing funds.

How can investors evaluate the credibility of crowdfunding projects?

Investors can assess credibility by examining the project team, business model, financial projections, and past performance on crowdfunding platforms.

What role does diversification play in crowdfunding investments?

Diversification helps reduce risk by spreading investments across different projects, industries, and platforms, safeguarding against potential losses.